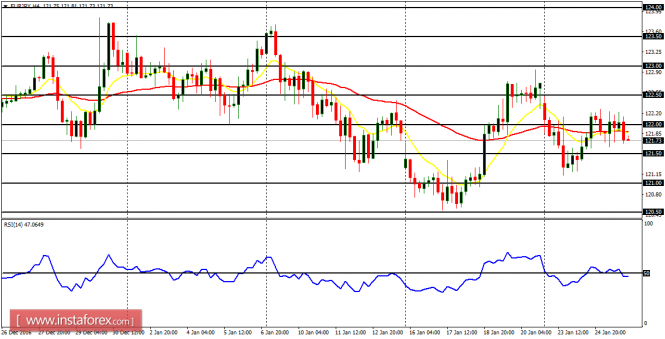

EUR/USD: The EUR/USD pair remains in a bullish mode. There is a Bullish Confirmation Pattern on the 4-hour chart and price is expected to go further upwards, following the current short-term consolidation. Price is still likely to reach the resistance lines at 1.0800 and 1.0850.

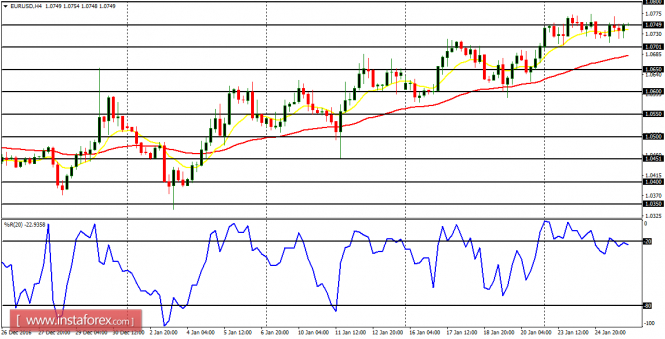

USD/CHF: The USD/CHF pair is still bearish, though it consolidated yesterday. The support levels at 0.9950, 0.9900, and 0.9850 remain valid targets for this week, although price may temporarily go above the psychological level at 1.0000, it would sooner or later go below it. The Williams" % Range period 20 is not far from the oversold region.

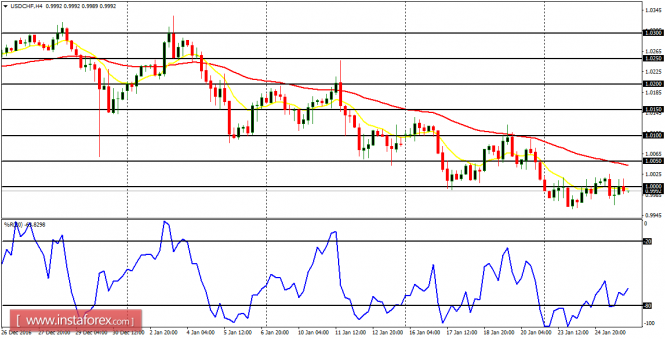

GBP/USD: It is interesting to see that GBP/USD has continued going upwards. Since the beginning of last week, price has moved upwards by 630 pips. Now the pair is above the accumulation territory at 1.2600 and going towards the distribution territory at 1.2650, which is the next target. Some fundamental figures are expected today and they may have an impact on the markets.

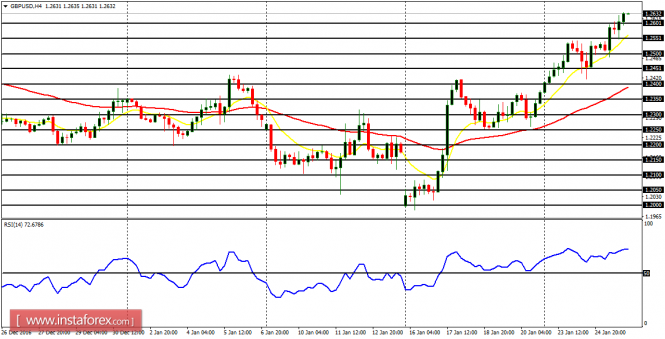

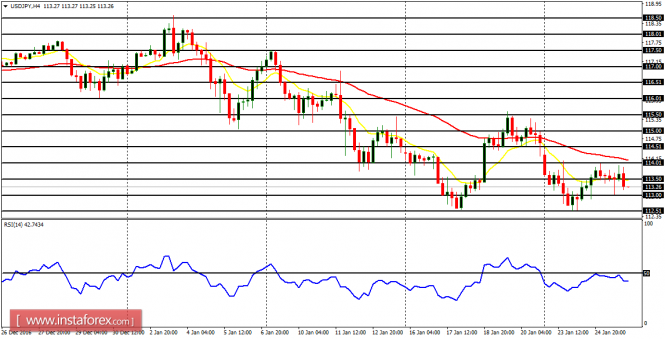

USD/JPY: There is a bearish signal on this pair – confirmed by the bearish confirmation pattern on the chart. The EMA 11 is below the EMA 56 and the RSI period 14 is below the level 50. This means that price is expected to continue going further and further downwards, reaching the demand levels 113.00 and 112.50.

EUR/JPY: This cross pair did not do anything significant yesterday. There would soon be a rise in momentum, and a movement above the supply zones at 122.50 and 123.00 would return the market into a neutral zone. On the other hand, a movement of 100 – 150 pips would help establish the presence of bears in the market.