After a continuous four-day decline, the main currency pair of the Forex market rose in yesterday's trading. Perhaps this course of events was facilitated by macroeconomic statistics, as well as the speech of the head of the Federal Reserve Bank of Boston Rosengren.

Thus, according to yesterday's reports, all three IFO indices for Germany came out stronger than analysts' forecasts. At the same time, the number of initial applications for unemployment benefits in the US increased more than expected. As for Rosengren's speech, the head of the Boston Federal Reserve made it clear that current employment, as well as the inflation indicator, are far from the values that were observed before the COVID-19 pandemic, and will remain at low levels for several years. Moreover, Eric Rosengren expressed fears that the US economy may shrink even further in the autumn-winter period if the COVID-19 epidemic is not localized, and additional financial assistance will not be sufficient to overcome the negative consequences caused by the coronavirus infection.

The main macroeconomic events of the last day of this week will be reports on orders for durable goods in the United States, which will be published at 13:30 London time. Williams, a member of the Federal Reserve's Open Market Committee, is also scheduled to speak.

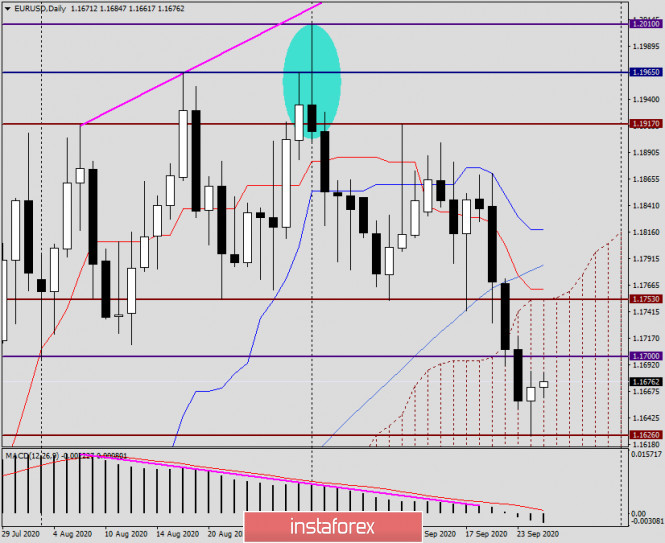

Daily

As already noted at the beginning of the article, the four-day decline of the main currency pair stopped yesterday. The bears intended to continue to put pressure on the quote, however, strong support was found at 1.1626. Thus, the assumption that the correction may begin after a decline in the price zone of 1.1620-1.1600 was confirmed. However, it will be too early for the euro bulls to rejoice. Trading on EUR/USD is below the key support level of 1.1700, the breakdown of which is still questionable.

If today and the entire week close above this mark, its breakdown will be considered false and the chances of resuming the upward trend will increase. If this fails and the session ends at 1.1700, we will most likely see a continuation of the downward trend for the main currency pair of the Forex market next week.

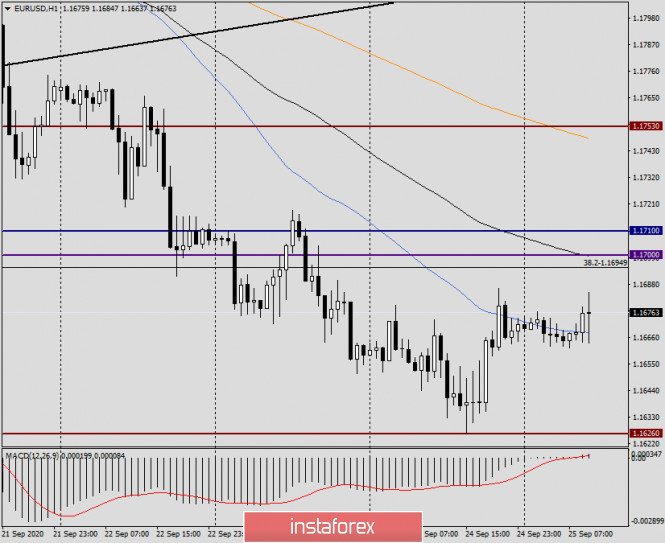

H1

A very significant moment is seen on the hourly chart. At this time, the pair is trading above the 50 simple moving average and is ready to continue rising. Characteristically, it is at 1.1700 that the 89th exponential moving average is located, which can significantly strengthen this level as resistance.

If characteristic candlestick patterns are indicating a reversal at 1.1700 on the hourly or four-hour timeframes, this will be a signal for opening sales. In this case, I recommend opening short positions on EUR/USD, however, with small goals in the area of 1.1650/40. You should look for higher selling prices near the strong technical level of 1.1740, but even in this case, it is better not to transfer open positions to Monday and close them before the end of current trading. Due to COVID-19, it is not known what figures we will open on Monday. If the situation with the spread of coronavirus worsens, a price gap is possible at the opening of trading.

The material has been provided by InstaForex Company - www.instaforex.com