For the euro/dollar pair, we continue to move downwards after passing through the price range of the noise range 1.1201 - 1.1182. The level of 1.1261 is the key support. For the pound/dollar pair, the continuation of the downward movement is expected after the passage of the noise range 1.2387 - 1.2345. The level of 1.2534 is the key support. For the dollar/franc pair, the level of 0.9561 is the key resistance for the top and the level of 0.9462 is the key support. For the dollar/yen pair, the price is in the correction zone from the downward structure. The level of 106.64 is the key resistance for the bottom and the level of 107.34 is the key support. For the euro/yen pair, we continue to monitor the local structure from June 16. The level of 120.22 is the key support. For the pound/yen pair, we will continue to move downward after the breakdown of the level of 132.43. The level of 133.70 is the key support.

Forecast for June 19:

Analytical review of currency pairs on the scale of H1:

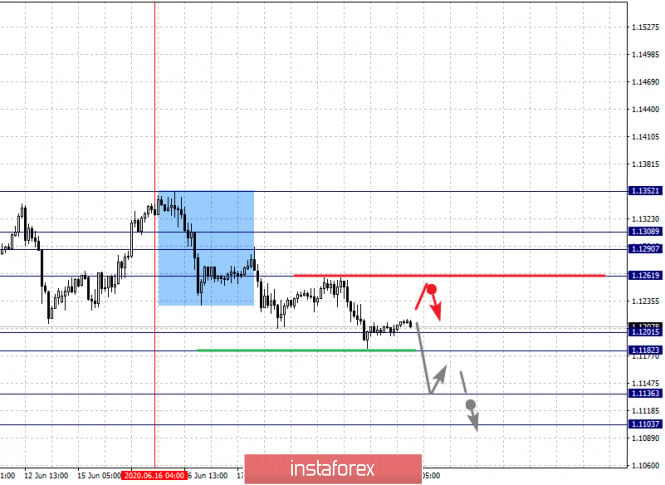

The key levels for the euro / dollar pair on the H1 scale are: 1.1352, 1.1308, 1.1290, 1.1261, 1.1201, 1.1182, 1.1136 and 1.1103. Here, we continue to monitor the local descending structure of June 16th. The continuation of the downward movement is expected after passing through the price range of noise 1.1201 - 1.1182. In this case, the target is 1.1136. For the potential value for the bottom, we considered it to be the level of 1.1103. We expect consolidation, as well as an upward pullback upon reaching which.

A short-term upward movement is possible in the range of 1.1261 - 1.1290. The range of 1.1290 - 1.1308 is a key support for the downward structure from June 16 and the price passing this range will lead to the formation of an upward structure. In this case, the target is 1.1352.

The main trend is the local descending structure of June 16

Trading recommendations:

Buy: 1.1262 Take profit: 1.1290

Buy: 1.1310 Take profit: 1.1350

Sell: 1.1180 Take profit: 1.1138

Sell: 1.1134 Take profit: 1.1105

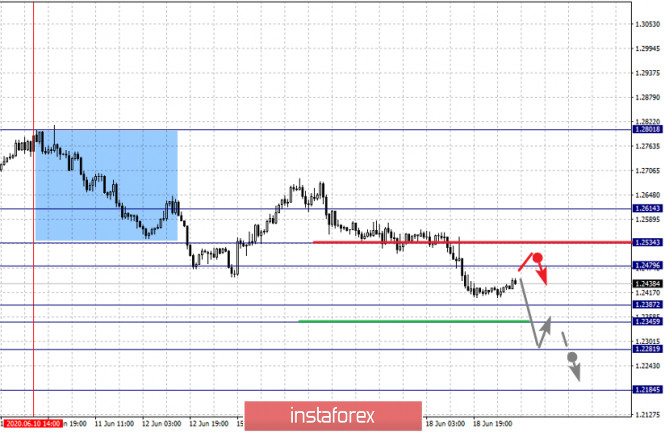

The key levels for the pound / dollar pair on the H1 scale are: 1.2614, 1.2534, 1.2479, 1.2387, 1.2345, 1.2281 and 1.2184. Here, we are following the development of the downward cycle of June 10th. Further downward movement is expected after the price passes the noise range 1.2387 - 1.2345. In this case, the target is 1.2281. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.2184. We expect consolidation, as well as an upward pullback upon reaching which.

A short-term upward movement is expected in the range of 1.2479 - 1.2534. The breakdown of the last level will lead to a deeper correction. In this case, the potential target is 1.2614.

The main trend is the descending structure of June 10

Trading recommendations:

Buy: 1.2480 Take profit: 1.2530

Buy: 1.2536 Take profit: 1.2612

Sell: 1.2345 Take profit: 1.2283

Sell: 1.2280 Take profit: 1.2186

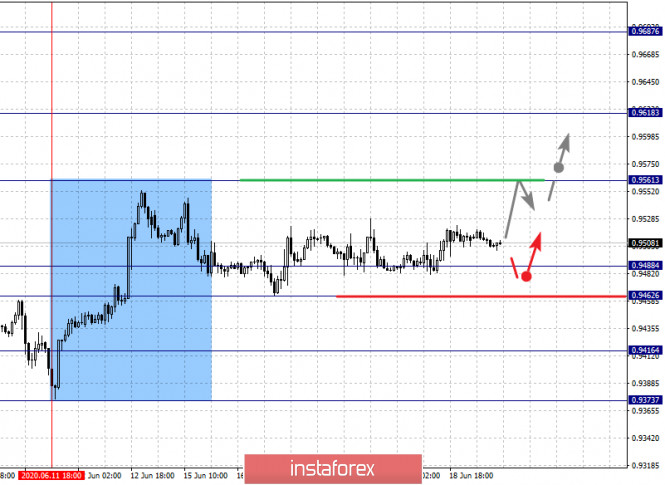

The key levels for the dollar / franc pair on the H1 scale are: 0.9687, 0.9618, 0.9561, 0.9488, 0.9462, 0.9416 and 0.9373. Here, the price forms expressed initial conditions for the top of June 11th. Further upward movement is expected after the breakdown of the level of 0.9561. In this case, the target is 0.9618. Price consolidation is near this level. The breakdown of the level of 0.9618 will lead to a pronounced movement to the potential target - 0.9687. We expect a pullback from this level.

A short-term downward movement is expected in the range 0.9488 - 0.9462. The breakdown of the last level will lead to deeper movement. Here, the target is 0.9416. This is the key support level for the top.

The main trend is the upward structure of June 11

Trading recommendations:

Buy : 0.9561 Take profit: 0.9615

Buy : 0.9620 Take profit: 0.9685

Sell: 0.9488 Take profit: 0.9464

Sell: 0.9460 Take profit: 0.9418

The key levels for the dollar / yen pair on the scale are : 108.39, 108.15, 107.67, 107.34, 106.64, 106.07, 105.78 and 105.08. Here, we are following the development of the descending structure of June 5th. Further downward movement is expected after the breakdown of the level of 106.64. In this case, the target is 106.07. A short-term downward movement, as well as consolidation are in the range of 106.07 - 105.78. For the potential value for the downward trend, we consider the level of 105.08. We expect an upward pullback upon reaching which.

A short-term upward movement is possible in the range 107.34 - 107.67. The breakdown of the last level will lead to a deeper correction. Here, the target is 108.15. We expect the initial conditions for the upward cycle to be formed before the noise range of 108.15 - 108.39.

The main trend is the downward cycle of June 5, the correction stage

Trading recommendations:

Buy: 107.35 Take profit: 107.66

Buy : 107.69 Take profit: 108.15

Sell: 106.64 Take profit: 106.07

Sell: 105.76 Take profit: 105.10

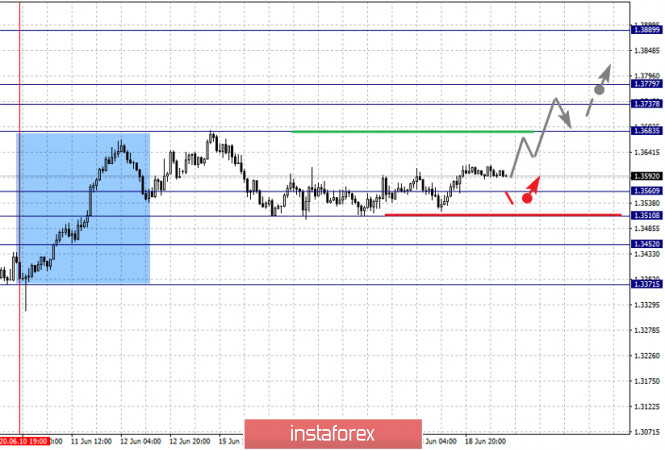

The key levels for the Canadian dollar / US dollar pair on the H1 scale are: 1.3967, 1.3889, 1.3779, 1.3737, 1.3683, 1.3560, 1.3510 and 1.3452. Here, we are following the ascending structure of June 10th. The continuation of the upward movement is expected after the breakdown of the level of 1.3683. In this case, the target is 1.3737. Price consolidation is near this level. The price passing the noise range of 1.3737 - 1.3779 should be accompanied by a pronounced upward movement. Here, the target is 1.3889. For the potential value for the top, we consider the level of 1.3967. We expect a downward pullback upon reaching this level.

A consolidated movement is possible in the range of 1.3560 - 1.3510. The breakdown of the last level will lead to the development of a deeper correction. Here, the goal is 1.3452. This is a key support level for the top and its breakdown will allow you to count on movement to the level of 1.3371.

The main trend is the upward structure of June 10

Trading recommendations:

Buy: 1.3683 Take profit: 1.3737

Buy : 1.3780 Take profit: 1.3888

Sell: 1.3508 Take profit: 1.3452

Sell: 1.3450 Take profit: 1.3371

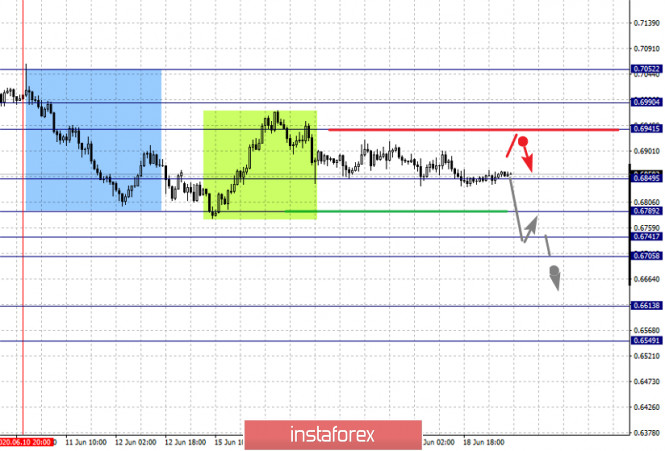

The key levels for the Australian dollar / US dollar pair on the H1 scale are : 0.7052, 0.6990, 0.6941, 0.6849, 0.6789, 0.6741, 0.6705. 0.6613 and 0.6549. Here, the price is in correction from the downward structure on June 10th. The continuation of the development of the downward trend is possible after the breakdown of the level of 0.6849. Here, the first goal is 0.6789. The breakdown of which, in turn, will allow us to rely on the movement to 0.6741. The price passing the noise range 0.6741 - 0.6705 will lead to a pronounced downward movement. Here, the target is 0.6613. For the potential value for the downward trend, we consider the level of 0.6549. We expect a pullback upward upon reaching which.

A short-term upward movement is expected in the range of 0.6941 - 0.6990. The breakdown of the level of 0.6990 will lead to the cancellation of the downward trend. In this case, the first target is 0.7052.

The main trend is the descending structure of June 10, the correction stage

Trading recommendations:

Buy: 0.6941 Take profit: 0.6988

Buy: 0.6992 Take profit: 0.7050

Sell : 0.6849 Take profit : 0.6790

Sell: 0.6787 Take profit: 0.6741

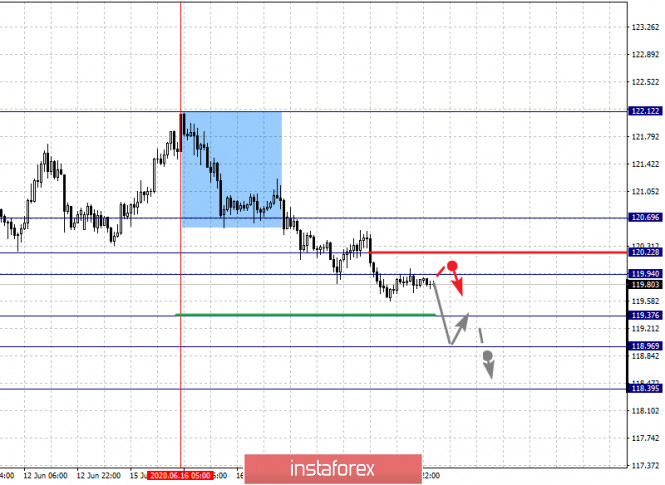

The key levels for the euro / yen pair on the H1 scale are: 120.69, 120.22, 119.94, 119.37, 118.96 and 118.39. Here, we follow the development of the local downward cycle of June 16. The continuation of the downward movement is expected after the breakdown of the level of 119.37. In this case, the target is 118.96. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 118.39. We expect a pullback upward upon reaching which.

A short-term upward movement is possible in the range of 119.94 - 120.22. The breakdown of the last level will lead to a deeper correction. Here, the goal is 120.69. This level is the key support for the downward structure from June 16.

The main trend is the local descending structure of June 16

Trading recommendations:

Buy: 119.94 Take profit: 120.20

Buy: 120.24 Take profit: 120.69

Sell: 119.37 Take profit: 118.98

Sell: 118.94 Take profit: 118.40

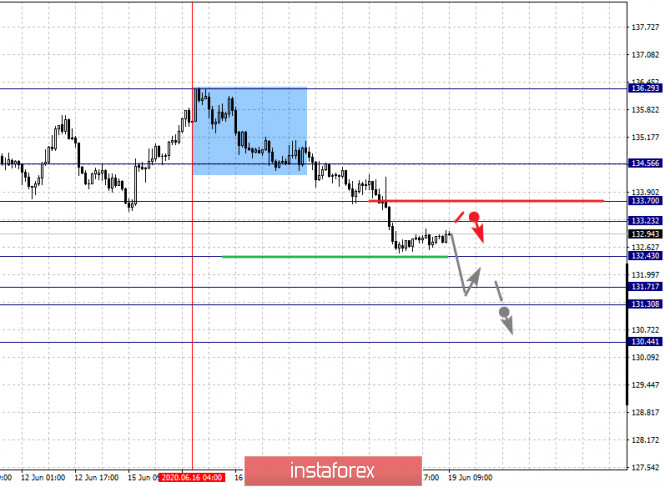

The key levels for the pound / yen pair on the H1 scale are : 134.56, 133.70, 133.23, 132.43, 131.71, 131.30 and 130.44. Here we continue to monitor the local descending structure of June 16th. Further downward movement is expected after the breakdown of the level of 132.43. In this case, the target is 131.71. Price consolidation is in the range of 131.71 - 131.30. For the potential value for the bottom, we consider the level of 130.44. We expect a pullback upward upon reaching which.

A short-term upward movement is possible in the range of 133.23 - 133.70. The breakdown of the last level will lead to a deeper correction. Here, the target is 134.56. This level is a key support for the downward structure from June 16.

The main trend is the local descending structure of June 16

Trading recommendations:

Buy: 133.23 Take profit: 133.70

Buy: 133.75 Take profit: 134.56

Sell: 132.40 Take profit: 131.73

Sell: 131.30 Take profit: 130.50

The material has been provided by InstaForex Company - www.instaforex.com