Hello, dear colleagues!

According to the results of yesterday's trading, the main currency pair of the Forex market managed to close the day's session in positive territory, that is, growth. Now it is difficult to understand exactly why the US currency is weakening, however, the fact remains. It is likely that the decline of the COVID-19 epidemic and the gradual normalization of the situation, including the economic one, significantly reduced pessimism and led to an appetite for risk sentiment.

As it became known today, the European Central Bank (ECB) has started working on a scheme of outstanding loans. However, they are still refraining from detailed comments by an official of the department.

If the second wave of COVID-19 begins, thanks to the created scheme, commercial banks will be better protected from the consequences of the coronavirus pandemic. In general, the ECB has recently been quite active in its anti-crisis measures. Perhaps this factor also supports the single European currency to some extent. However, it will be interesting to know how the Fed will respond. Let me remind you that today at 19:30 (London time), the European Central Bank will publish its decision on interest rates, and will also present updated economic forecasts to market participants. Half an hour after that, Fed Chairman Jerome Powell will hold a press conference.

And today we have already received reports from the Eurozone on the final GDP data for the first quarter. The actual numbers can be seen in the economic calendar, and now in the technical analysis and trading recommendations for EUR/USD.

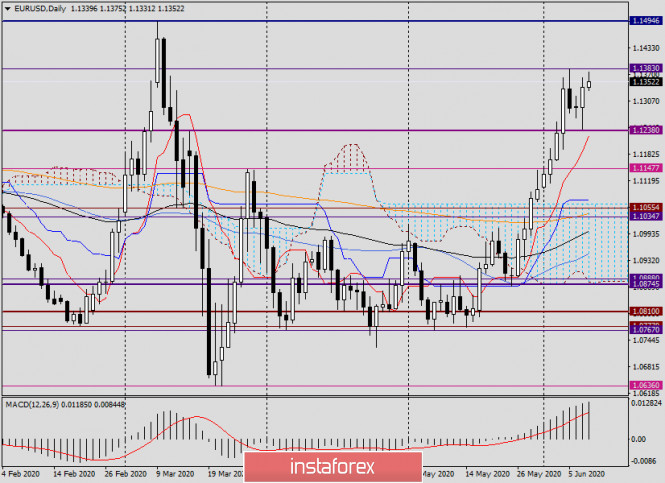

Daily

Yesterday, the pair was not only able to level losses but also completed Tuesday's trading in positive territory, ending Tuesday's trading session at 1.1340. However, data from the US on consumer prices, which will be presented this Friday, will be of the greatest importance.

For now, as expected, the main price dynamics of the main currency pair remains upward. I do not give up on the idea that if the bullish sentiment for the euro/dollar persists and it consolidates above 1.1383 (highs on May 5), the quote will have all the technical prerequisites for further growth towards the important psychological level of 1.1500. However, before that, a lot of water will leak. In the meantime, at the end of this article, we will proceed to the consideration of charts for finding trading solutions for EUR/USD.

Despite yesterday's strengthening, the players did not have enough strength to increase their resistance near the important technical level of 1.1380. I think that the mark of 1.1380 will be attempted again and, most likely, will end with a breakdown of this extremely important and technically strong level.

H4

If this mark turns out to be in the hands of euro bulls, the growth of the euro to the area of 1.1400-1.1420 is likely to continue.

Trading recommendations for the EUR/USD:

The most preferred at the moment are purchases that are recommended to be considered after a short decline in the selected zone, without fixing 1.1200.

I recommend setting the suggested goals for opening long positions near 1.1400.

All the best!

The material has been provided by InstaForex Company - www.instaforex.com