It seems that everything is correct, and the single European currency grew quite reasonably. But why so modest? After all, one look at the US data is enough to earn a heart attack, and drink sedatives for the rest of your days. Such data should have sent the euro soaring at the speed of light. Such a situation in the labor market of the United States has not been seen since the Great Depression.

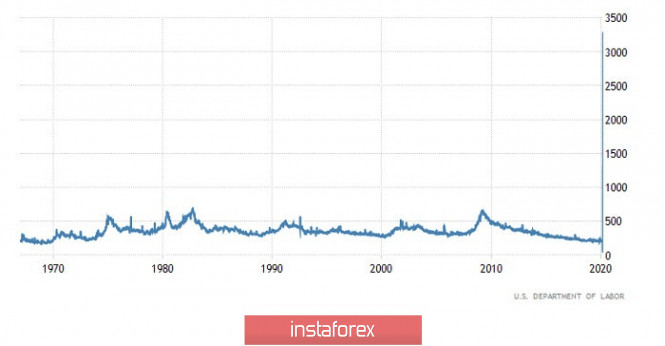

Honestly, this has never been seen before. It's not even a question of how fast the number of initial applications for unemployment benefits has increased, but how no one could even imagine such a value. Yes, the number of these initial applications for unemployment benefits increased from 282 thousand to 3 283 thousand. This is something unimaginable. For the first time in history, the number of initial applications for unemployment benefits exceeded the number of repeated applications. After all, it was predicted that the number of applications would increase to 1,090 thousand. The number of repeated applications increased from 1,702 thousand to 1,803 thousand. So do not console yourself with the illusions that this is a random and insignificant leap, and in the near future, all of these people will find a new job. No, the labor market simply cannot cope with such an influx of the army of the unemployed. Even assuming that the situation on the labor market will no longer worsen, it will take a very, very long time to rake this blockage. Yes, and what kind of work they can find if such a shaft of applications is possible only if people lost their jobs due to the elementary bankruptcy of employers. The coronavirus epidemic, which hits the United States the most, with the highest numbers of people infected, has led to incredible losses in the service sector. Many entrepreneurs cannot stand this, and they are trivial to go broke. Well, their employees replenish the army of the unemployed. And given that the situation with coronavirus is getting worse day by day in the United States, things will only get worse.

Number of Initial Jobless Claims (United States):

So it is really not clear why the single European currency has grown so modestly. It should grow and grow in time. Apparently, it is under pressure from the general European situation with coronavirus, and the shock of market participants due to the increase in the number of applications for unemployment benefits. They simply do not believe their own eyes, and hope that there is some mistake. And in general, where do they run, because the bulk of capital is controlled by US investors, and the world is not calm right now. So the money is stuck in the United States itself.

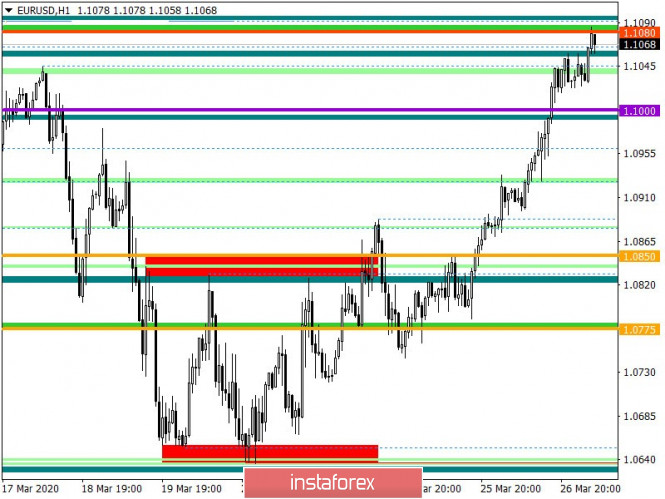

From the point of view of technical analysis, we see a recovery process, relative to the downward inertia course, where at the beginning of the week more than 400 points were worked out. In fact the quote returned to the previous stagnation area of 1,1000//1,1080//1,1180, where oscillation activity remains high. Regarding volatility, we have an average of 167 points calculated from the beginning of the trading week, and this credit is attributed to the external background, which does not stop surprising traders for a single day.

In terms of the general review of the trading schedule, we see a long-term downward trend, where during the next attempt to update the record lows, a periodic support was found in the form of the 1.0650 level, on the basis of which a correction began to form.

We can assume a temporary fluctuation between the levels of 1.1000/1.1080, where the main move will come after consolidating the price outside the established boundaries.

Concretizing all of the above into trading signals:

- We will consider long positions after consolidating the price above 1.1090, with the prospect of a move to 1.1180.

- We consider short positions in two stages: the first, descent lower than 1.1020, with a move to 1.1000; the second option is the main one, where you should identify a price fix lower than 1.0990, with the prospect of a move of 1.0900.

From the point of view of a comprehensive indicator analysis, we see that, based on local upward movement, the indicators of technical tools on the minute and hour periods occupied the upside. The daily periods where the indicators are plotted continue to indicate a downward interest, due to the main trend.