European stock exchanges, following Asian ones, are trading in the red zone, as published macroeconomic statistics turned out to be noticeably worse than forecasts. German 10-year bonds lost 6.3% at one point, demand for securities in the UK and Switzerland has sharply increased. Oil is losing almost 2% amid growing concerns about demand for raw materials, and there is no reason to believe that the growth in demand for risky assets may resume in the short term.

But until recently, it seemed that the peak of panic was over. The OECD composite indicator, which usually reacts ahead of schedule, shows that as of early February, the business cycle has formed a turning point, that is, a half-wave of growth has begun, which means that demand for risky assets will be outstripped.

At the same time, the OECD in the comments emphasizes that the indicator does not yet reflect the potential negative effect of coronovirus. Of course, China will suffer the most, its real GDP growth will slow down significantly, however, data for the first quarter will be available only in April.

China is also trying to be proactive, and therefore reports of new incentive measures are taken with understanding, the announced steps (lowering taxes, easing monetary policy, increasing government spending) will also ultimately contribute to increased demand. But the latest news from Japan threatens to reverse OECD calculations. After a failed Q4 report on GDP in 2019, which marks the beginning of a technical recession, an expert group led by Prime Minister Shinzo Abe said that control over the spread of coronavirus has been lost. Mizuho Bank notes that Japan is one step away from the fact that the rest of the world will see it as a cluster of coronavirus, and this is not only a problem for tourism or falling domestic demand, but a threat to the Olympic Games.

The slowdown in sales was due to the expectation that the spread of coronavirus will slow down and mortality from it will decrease. Apparently, there are not many reasons for such conclusions. Judging by the latest data showing a strong slowdown in Japan and the eurozone, we are waiting for a reassessment of the economic situation downward, which entails the sale of risky assets and an increase in the demand for defensive assets.

EURUSD

The ZEW economic sentiment indicator for Germany fell sharply in February, falling to 8.7p from 26.7p a month earlier, the assessment of the economic situation also worsened, and, as emphasized in the press release, "in late 2019 and early 2020, the German economy turned out to be worse than expected. " We add here the reaction to the outbreak of coronavirus, which threatens, if not blocking, then drastically slowing down world trade in order to conclude that the hopes for a quick recovery after the failure in 2018/19 are unlikely to be realized.

The situation is similar in the eurozone, the ZEW index fell from 25.6p to 10.4p, and now, until Friday, when the PMI Markit indices and consumer inflation data for January are published, the euro has no reason to reverse.

Attempts to grow due to local overselling will be blocked near 1.0878, the fall will not hold back anything, and therefore the euro will tend to a long-term low of 1.0338. Short-term support can be found near 1.0725, but it will not hold back for a long time.

GBPUSD

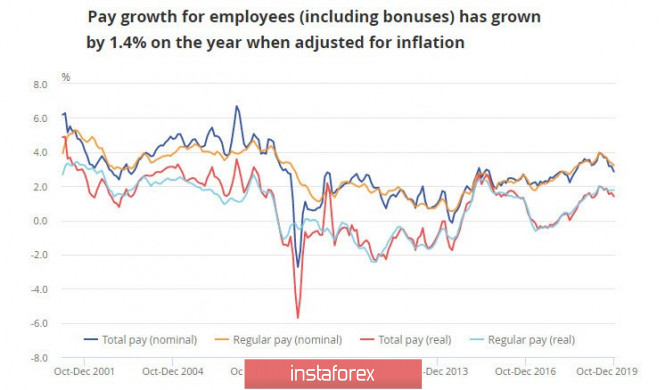

The UK employment report for October - December was mixed. Employment rose to a record 76.5%, unemployment remained unchanged at 3.8%, but wage growth slowed from 3.2% to 2.9%, which is a negative sign from the point of view of inflationary prospects.

However, the pound reacted with growth, and the reason here can only be that a decrease in inflation will serve as the basis for new stimulus measures both from the government and the Bank of England. The draft budget will be presented on March 11, and market participants expect that by this date the new government's position "spend, spend and spend" will be indicated.

An attempt to grow is unlikely to lead to a breakdown of resistance of 1.3068, the impulse has no internal strength, and therefore it is logical to sell near the local peak with the target at 1.2969, stop slightly above 1.3068.

The material has been provided by InstaForex Company - www.instaforex.com