The dollar returned to the leading position of the G10 currencies, receiving strong support after the publication of the ISM Manufacturing January report. Thus, the roller coaster continues - if the index declined below the forecast value in December and the overall picture of the US industry looked quite gloomy, then in January, everything changed magically - there is growth to 50.9p from 47.8p which significantly exceeded forecasts. Moreover, the index surprisingly ignores both the threat of the coronavirus and the Boeing problem (the Chicago regional index, where the company's headquarters is located, declined in January from 48.9p to 42.9p).

At the same time, there is a danger of a sharp decline in February since the data on the current report were collected before January 20, and ISM will return again to the reduction zone. Most likely, we see markets moving the conclusion of the first phase of a trade agreement between the United States and China.

Prior to the publication of the ISM index on the services sector on Wednesday, the dollar is likely to feel confident, because it will benefit both economic factors and a new wave of panic. On the other hand, the demand for oil in China declined by 20%, which led to a strong drop in quotes. Today, an unscheduled meeting of the OPEC + technical committee will begin. Volatility is likely to remain high before the ministerial meeting on February 14-15, which will also indirectly support the dollar and protective instruments.

There are no reasons to expect a reduction in panic yet; signals for a reversal may be reports of a slowdown in the spread of coronavirus or progress in vaccine development. Despite the growth of stock indices after a wave of strong decline, demand for bonds does not decline, which indirectly indicates a high probability of a new wave of panic.

EUR/USD

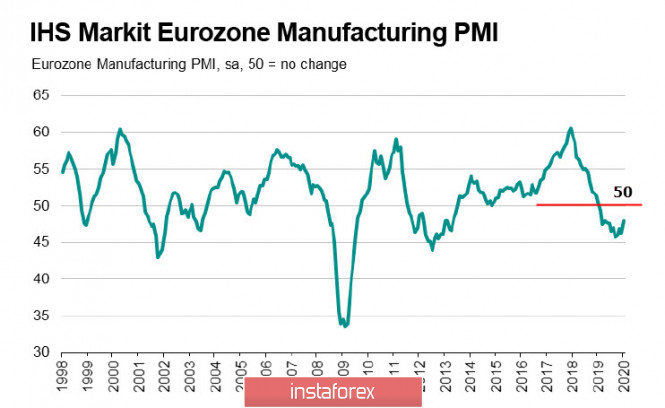

In the Eurozone, the manufacturing sector did not leave the contraction zone unlike the United States. The updated Markit index was 47.9p in January, which is slightly better than the December 46.3p. The emerging reversal, which added optimism after the positive reports of Ifo and ZEW, has not yet received support.

The calendar in the eurozone is not saturated this week, so the euro will be based more on market reactions to macroeconomic reports in the US and the general dynamics of the tension associated with the spread of coronavirus.

The technical picture is still bearish, despite a strong pullback from a 2-month low. The resistance zone of 1.1080 / 1100 has survived and on Tuesday, trading in the range of 1.1020 / 80 is likely with a tendency to the lower boundary.

GB/PUSD

The pound also quickly returned to the range, as it tried to get out of it. There are several reasons for this: the strong ISM in the USA, which contributed to the strengthening of the dollar, as well as the surpassing the reaction of the market to Johnson's confrontational statements regarding future negotiations with the EU. Johnson insists on a new policy to build rules for building relations between the UK and the EU, citing Australia's example of a number of close trading partners. London is not happy with current EU standards, and despite a rather mild reaction from EU chief negotiator Bernier, who promised to "give the UK maximum access to its market" if EU standards are respected, the pound returned to the lower end of the range with a threat to go below support zone 1.2950 / 70.

However, London is firmly committed to concluding a trade deal by the end of 2020. This is possible only in one case - if we abandon the established practice, abandon the accepted procedure and follow the path of the United States, forcing China to make a deal in an emergency. Johnson probably expects to be on the right side after the US embarks on a siege of the EU to revise trade relations in the same way as with China.

For the short term, the pound remains under bearish pressure. The threat of a rate cut by the Bank of England is more than real. Growth to the resistance zone of 1.3025 / 40 can be used for sales and the goal is to break through the resistance of 1.2950 / 70 and move to the low of December which is particularly the level of 1.2902.

The material has been provided by InstaForex Company - www.instaforex.com