The Australian dollar today completely lost ground: after the release of conflicting data on the labor market in Australia, the AUD/USD pair fell while updating multi-year lows. The last time the price was at such lows was 11 years ago - back in 2009. It should be noted right away that such price dynamics are caused not only by a weak macroeconomic report - first of all, traders are concerned about the prospects of the RBA monetary policy. Published on Tuesday, the minutes of the Australian central bank's last meeting fueled speculation on this subject, while today's release has become a kind of "last straw".

Let me remind you that at the end of the first meeting of the RBA this year, the regulator voiced a signal that it does not exclude further easing of monetary policy. The minutes of this meeting, published the day before yesterday, somewhat eased concern about the dovish intentions of the central bank. The Australian regulator acknowledged that the risks of further easing monetary policy parameters "outweigh its benefits." That is, on the one hand, the Reserve Bank of Australia is ready to resort to decisive action in response to the slowdown of the national economy and the economy of China. On the other hand, members of the central bank stated the need to "balance the risks that inevitably involve even lower interest rates."

The market interpreted this wording in favor of the Australian currency - they say, the central bank will resort to lower rates only in extraordinary situations. That is why the rather dovish minutes exerted a slight downward pressure on the pair.

Nevertheless, the minutes of the February meeting laid the foundation for strong volatility for the pair in the future. The fact is that the RBA members "linked" the issue of monetary easing with the dynamics of Australia's key macroeconomic indicators. According to them, the need to reduce rates depends on progress or regression in achieving the central bank's goals for inflation and employment. This suggests that the data on the growth of the Australian labor market and the main indicators of inflation are now viewed by the market through the prism of further prospects for the RBA monetary policy.

Actually, for this reason, the aussie slumped in almost all of the pairs today (not only against the US dollar). Published data reinforced rumors that the regulator will lower rates this spring. In particular, according to the Bank of Australia, the RBA members will announce this step at the March meeting, and they will reduce the interest rate by 25 basis points in April .

In my opinion, the regulator will take a wait-and-see attitude approximately until the summer. Firstly, by this time it will become clear how seriously the coronavirus slowed down the Chinese economy (and, as a consequence, the world economy). Secondly, the Australian regulator in six months will be able to see a more complete picture regarding the dynamics of indicators of the national economy.

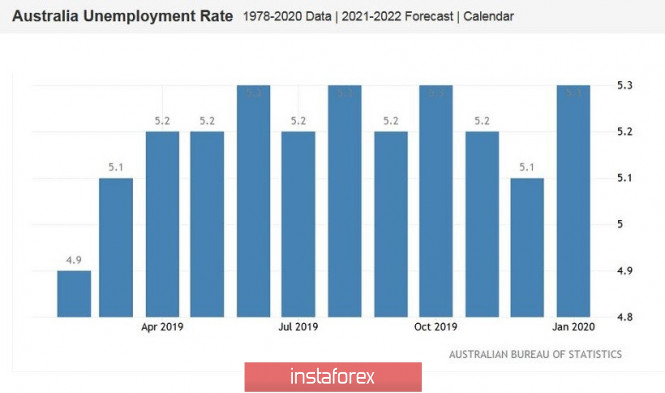

In fairness, it is worth saying that the latest Australian labor market data was not catastrophic. The market focused on rising unemployment to 5.3% - this fact served as a kind of red flag for traders who panicked over the rate cut this spring. Although the remaining components came out better than expected. For example, the number of employees in January increased by 13 thousand, while experts expected growth by only 10 thousand. Another positive point of today's report is the growth of full employment. This component jumped to 46 thousand. On the contrary, part-time employment declined by 32 thousand. This trend can have a positive effect on the dynamics of wage growth, as regular positions, as a rule, offer a higher level of wages and a higher level of social security. The share of the able-bodied population was 66.1% (with a forecast of growth to 66.0%). This fact, in theory, was supposed to partially offset the negative effect of rising unemployment.

Thus, the Australian today fell under the hot hand of traders who were ready to sell the aussie since Tuesday, when the minutes of the last RBA meeting were published. Today, the market has gotten a chance to fulfill its intentions: an increase in unemployment has become a signal that the regulator will nevertheless lower the rate in the foreseeable future. In my opinion, this conclusion seems premature, but the principle of sell by rumors still works. In addition, the general hegemony of the US dollar and the ongoing panic over the spread of coronavirus reinforces the pair's downward momentum. Bears overcame almost all levels of support, heading towards the 65th figure. If the fundamental picture for the pair does not change, then sellers will test the most powerful support level in the near future, which is located at 0.6570 and corresponds to the lower line of the Bollinger Bands indicator on the monthly chart.

The material has been provided by InstaForex Company - www.instaforex.com