Forecast for January 30:

Analytical review of currency pairs on the scale of H1:

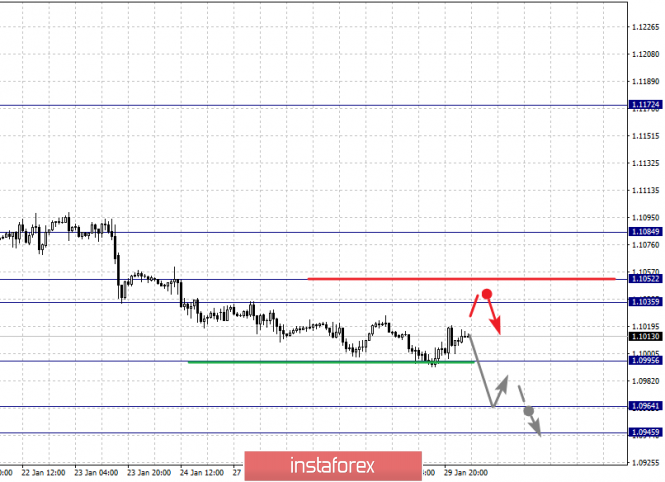

For the euro / dollar pair, the key levels on the H1 scale are: 1.1084, 1.1052, 1.1035, 1.0995, 1.0964 and 1.0945. Here, we are following the descending structure of January 16. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.0995. In this case, the target is 1.0964. For the potential value for the bottom, we consider the level of 1.0945. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 1.1035 - 1.1052. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1084. This level is a key support for the downward structure. We expect the initial conditions for the upward cycle to be formed before it.

The main trend is the descending structure of January 16

Trading recommendations:

Buy: 1.1035 Take profit: 1.1051

Buy: 1.1054 Take profit: 1.1082

Sell: 1.0995 Take profit: 1.0970

Sell: 1.0964 Take profit: 1.0947

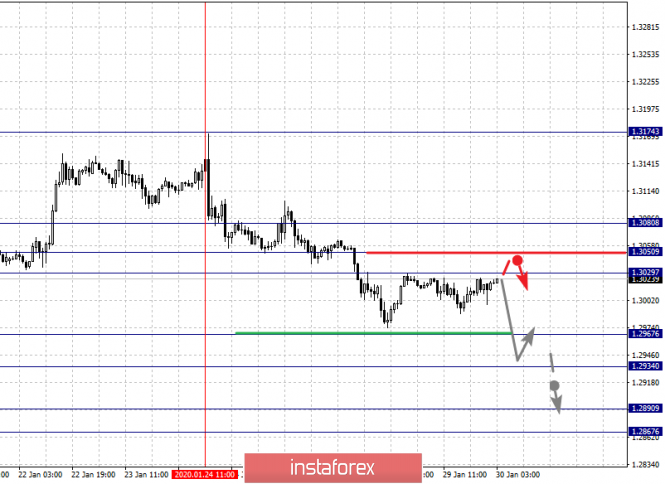

For the pound / dollar pair, the key levels on the H1 scale are: 1.3080, 1.3050, 1.3029, 1.2967, 1.2934, 1.2890 and 1.2867. Here, we are following the development of the downward cycle of January 24. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2967. In this case, the target is 1.2934. Price consolidation is near this level. Its price passage should be accompanied by a pronounced downward movement to the level of 1.2890. For the potential value for the bottom, we consider the level of 1.2867. Upon reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is possibly in the range of 1.3029 - 1.3050. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3080. This level is a key support for the bottom.

The main trend is the descending structure of January 24

Trading recommendations:

Buy: 1.3029 Take profit: 1.3050

Buy: 1.3052 Take profit: 1.3080

Sell: 1.2965 Take profit: 1.2936

Sell: 1.2932 Take profit: 1.2890

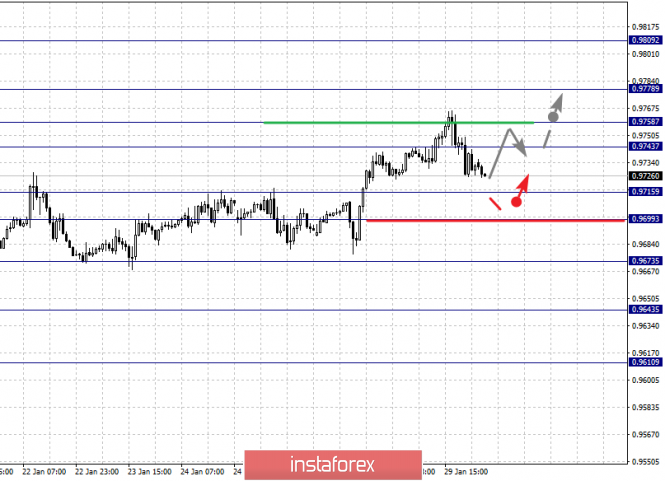

For the dollar / franc pair, the key levels on the H1 scale are: 0.9809, 0.9778, 0.9758, 0.9743, 0.9715, 0.9699 and 0.9673. Here, we are following the development of the ascending structure of January 16. Short-term upward movement is expected in the range of 0.9743 - 0.9758. The breakdown of the latter value will lead to a movement to the level of 0.9778. Price consolidation is near this level. We consider the level of 0.9809 to be a potential value for the upward movement; upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9715 - 0.9699. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9673. This level is a key support for the top.

The main trend is the upward cycle of January 16

Trading recommendations:

Buy : 0.9743 Take profit: 0.9756

Buy : 0.9758 Take profit: 0.9776

Sell: 0.9715 Take profit: 0.9700

Sell: 0.9697 Take profit: 0.9675

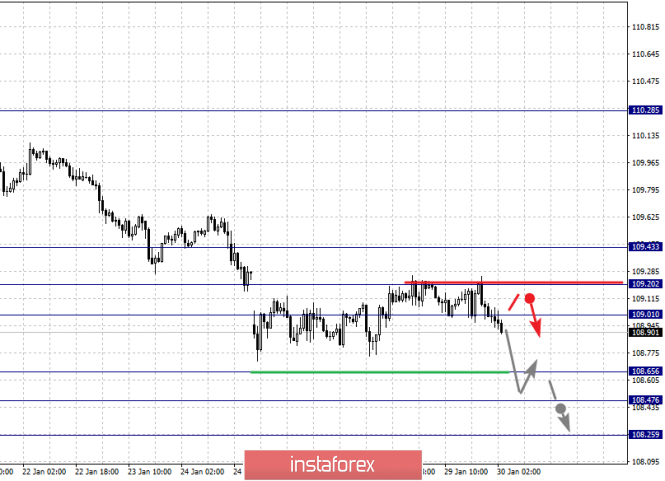

For the dollar / yen pair, the key levels on the scale are : 109.43, 109.20, 109.01, 108.65, 108.47 and 108.25. Here, we are following the downward cycle of January 17. Short-term downward movement is possible in the range of 108.56 - 108.47. The breakdown of the last value will lead to a movement to a potential target - 108.25, and upon reaching this level, we expect a pullback to the top.

Consolidated movement is possibly in the range of 109.01 - 109.20. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 109.43. This level is a key support for the downward structure.

Main trend: potential downward structure of January 17, correction stage

Trading recommendations:

Buy: Take profit:

Buy : 109.23 Take profit: 109.40

Sell: 108.65 Take profit: 108.48

Sell: 108.45 Take profit: 108.25

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3312, 1.3271, 1.3238, 1.3198, 1.3178, 1.3157 and 1.3126. Here, we are following the development of the upward cycle of January 22. The continuation of the movement to the top is expected after the breakdown of the level of 1.3198. In this case, the target is 1.3238. Price consolidation is near this level. There is a short-term upward movement in the range of 1.3238 - 1.3271. Hence, a reversal to a correction is also possible. The potential value for the top is considered to be the level of 1.3312.

Consolidated movement is possibly in the range of 1.3178 - 1.3157. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3126. This level is a key support for the top.

The main trend is the local ascending structure of January 22, the correction stage

Trading recommendations:

Buy: 1.3198 Take profit: 1.3236

Buy : 1.3240 Take profit: 1.3270

Sell: Take profit:

Sell: 1.3155 Take profit: 1.3130

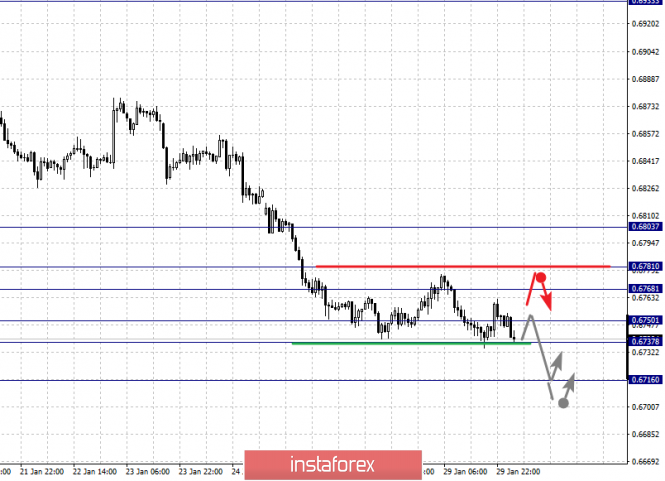

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6803, 0.6781, 0.6768, 0.6750, 0.6737 and 0.6716. Here, we are following the development of the descending structure of January 16. Short-term downward movement is expected in the range 0.6750 - 0.6737. The breakdown of the latter value will lead to movement to a potential target - 0.6716. We expect a pullback to the top from this level.

Short-term upward movement is expected in the range of 0.6768 - 0.6781. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6803. This level is a key support for the bottom and before it, we expect the initial conditions for the upward cycle to be formed.

The main trend is the descending structure of January 16

Trading recommendations:

Buy: 0.6768 Take profit: 0.6780

Buy: 0.6783 Take profit: 0.6800

Sell : 0.6750 Take profit : 0.6737

Sell: 0.6736 Take profit: 0.6716

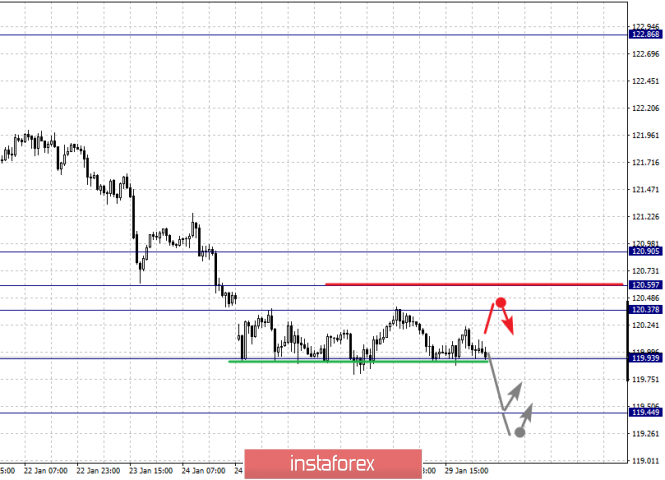

For the euro / yen pair, the key levels on the H1 scale are: 120.90, 120.59, 120.37, 119.93 and 119.44. Here, we are following the descending structure of January 16. The continuation of movement to the bottom is expected after the breakdown of the level of 119.90. In this case, the potential target is 119.44. We expect a pullback in correction upon reaching this level.

Short-term upward movement is possibly in the range of 120.37 - 120.59. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 120.90. This level is a key support for the downward structure.

The main trend is the descending structure of January 16

Trading recommendations:

Buy: 120.37 Take profit: 120.57

Buy: 120.61 Take profit: 120.90

Sell: 119.90 Take profit: 119.48

Sell: Take profit:

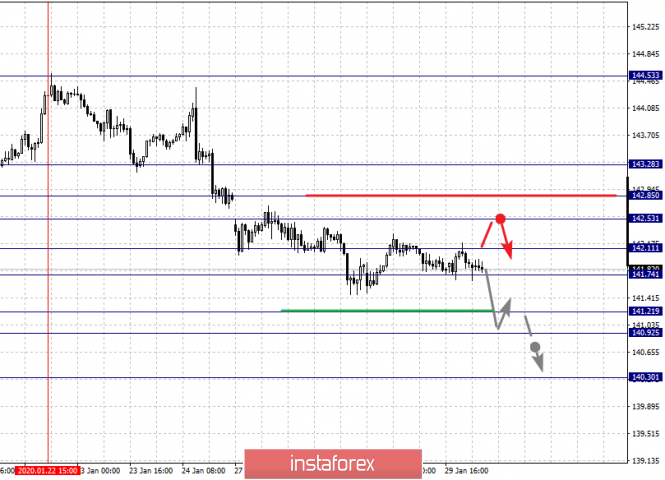

For the pound / yen pair, the key levels on the H1 scale are : 143.28, 142.85, 142.53, 142.11, 141.74, 141.21, 140.92 and 140.30. Here, we are following the development of the downward cycle of January 22. Short-term downward movement is expected in the range of 142.11 - 141.74. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the goal is 141.21. Price consolidation is in the range of 141.21 - 140.92. For the potential value for the bottom, we consider the level of 140.30. We expect a pullback to the top upon reaching this level.

Short-term upward movement is expected in the range of 142.53 - 142.85. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 143.28. This level is a key support for the downward movement.

The main trend is the descending structure of January 22

Trading recommendations:

Buy: 142.53 Take profit: 142.85

Buy: 142.87 Take profit: 143.28

Sell: 142.10 Take profit: 141.76

Sell: 141.72 Take profit: 141.25

The material has been provided by InstaForex Company - www.instaforex.com