On Monday, the tension in the market has somewhat subsided after a report by economic adviser of D. Trump, Larry Kudlow that trade negotiations between the US and China are going well and that duties that will be effective in December can be canceled.

This news caused a surge of optimism and an increase in demand for risky assets. In turn, equity markets in Europe and North America received support as well as government bond yields in economically strong countries. The yield on benchmark of 10-year-old treasuries jumped 0.6% from opening at 1.740% to 1.803%. Against this background, the American dollar also received local support, however, it should be recognized that its increase was only temporary.

After some time, following Kudlow, the Secretary of Commerce of the United States, W. Ross, commented on Fox Business, saying that there is a priority to the quality of the trade deal between Washington and Beijing over the terms of its conclusion. At the same time, he added that the agreement may not necessarily be signed in November at the APEC summit, which will be held in Chile on November 16-17, as it should reflect the "right deal".

At present, given the skepticism of Ross, the dollar was under pressure again and its ICE index corrected down, having lost virtually all of its growth.

Moreover, the events yesterday vividly demonstrated how important the events for the market around the US-China trade negotiations and the fermentation process associated with Brexit.

The quotes of gold, which have been stomping on the spot for the second week, have come under pressure in the wake of Kudlow's message, but the lack of details of the negotiation process, as well as Ross' pessimistic words regarding the prospects of the negotiations themselves, have stopped the process of quotation reduction and even at Asian trading led to their local growth.

In general, assessing the current situation in the markets, we believe that the tension in the markets will remain at least until the end of this month, when the Fed will hold a meeting on monetary policy and at least somehow resolve the issue on Brexit.

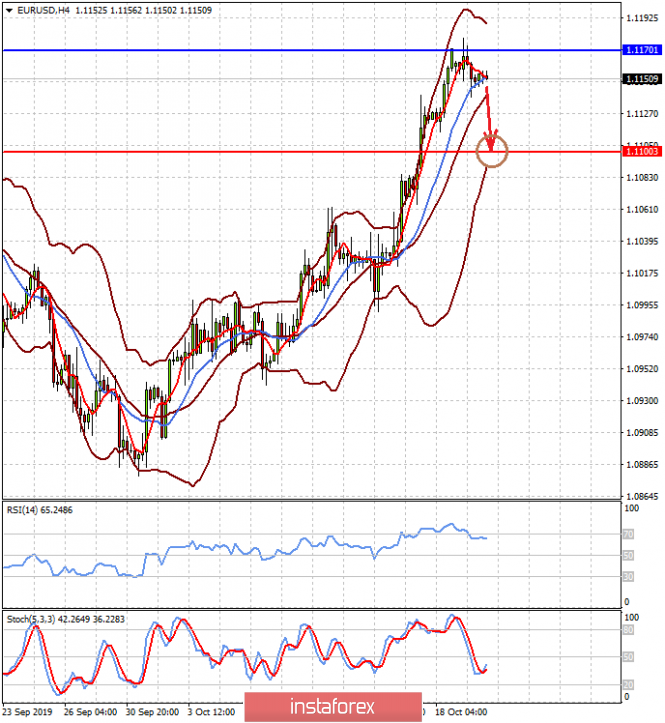

Forecast of the day:

EUR/USD is trading below the level of 1.1170. We believe that if the price does not rise above this level, there is a possibility of its correction by 1.1100 before the ECB meeting on monetary policy this week.

Gold on the spot continues to remain in the range 1476.80-1496.85 in the wake of the uncertainty surrounding the developments around Brexit and the US-Chinese trade negotiations. However, if the dollar receives support amid rising US Treasuries, and quotes of the "yellow" metal fall below the lower boundary of the range, then the likelihood of falling quotes will increase, first to 1473.50, and then to 1461.90.