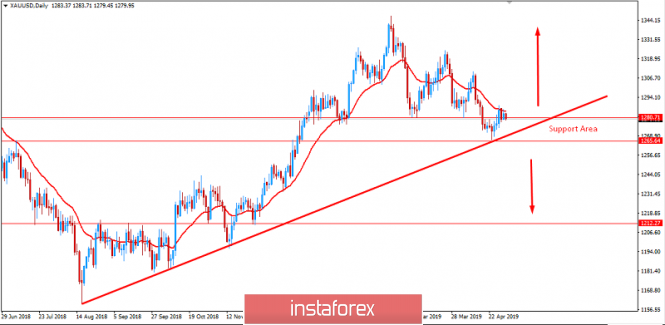

Gold has been trading at the edge of the $1,280 support area for a few days in a row. The price is expected to climb higher as long as it remains above $1,265 with a daily close.

Ahead of the FOMC policy decision, the Federal Funds Rate report and NFP this week, GOLD is expected to regain momentum if the upcoming events inspire optimism to investors. As Fed's interest rates have a proportional relationship with the US dollar, they determine the opportunity cost of holding gold. Gold is generally used by investors as a safe-haven investment amid economic and political concerns. However, the precious metal has come under pressure lately as equity markets have hit record highs and most economic data have eased fears about a slowdown in the global economic growth. Gold is yet to overcome the bearish factors, and any rallies in the metal might be short-lived

The overall trend is bullish. Trading above the trend line support and support area of $1,265 indicates that the upward momentum is yet to be built again, though any contradictory situation can lead to strong bearish pressure.

A sustained move over $1,280 is expected to lead to further upward pressure, but a correctional decline and current impulsive bearish pressure indicate higher volatility and indecisive market sentiment. Though the market is still quite volatile, the dynamic level of 20 EMA holding the price as resistance is a big threat to the buyers. For a conservative and safe approach, it would be better to wait for a daily close above $1,290 to buy and expect the price to reach the $1,350 resistance area in the future.

On the other hand, a break below $1,265 will not only lead to impulsive bearish pressure but it can change the overall definite trend momentum as well which would impact price gains.

SUPPORT: $1,212, $1,265, $1,280

RESISTANCE: $1,290, $1,300, $1,350

BIAS: BULLISH

MOMENTUM: VOLATILE