NZD/JPY has been quite non-volatile and impulsive with the bearish pressure since it bounced off 79.00 area with a daily close. JPY having optimistic approach and mixed economic reports managed to gain ground while NZD is silent throughout the holidays leading to further weakness in the process.

Due to holidays, NZD did not have any economic reports or events this week which could inject any bullish pressure in the process. As a result, JPY rose further despite the mixed economic reports which are mostly negative. Recently the BOJ Core CPI report was published with a decrease to 0.5% which was expected to be unchanged at 0.6% and the Housing Starts decreased to -0.6% from the previous value of 0.3% which was expected to be at -0.2%. Today the Tokyo Core CPI report was published as expected with a decrease to 0.9% from the previous value of 1.0% and the Unemployment Rate increased to 2.5% which was expected to be unchanged at 2.4%. Moreover, the Prelim Industrial Production decreased to -1.1% from the previous value of 2.9% which showed a better than expected value of -1.7% and the Retail Sales decreased to 1.4% from the previous value of 3.6% which was expected to be at 2.1%.

As of the current scenario, JPY is expected to gain further momentum against NZD though certain corrections and pullbacks may be observed due to recently published worse JPY reports. However, as NZD remains silent and dovish with the upcoming economic reports, further bearish gains on the JPY side are expected in this pair.

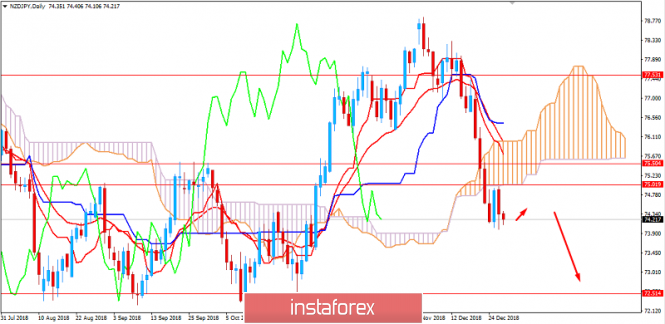

Now let us look at the technical view. The price breached below 75.00-50 support area and the dynamic support area of Kumo Cloud with a daily close which is expected to lead to further bearish pressure. As the price is residing quite away from the dynamic levels like 20 EMA, Tenkan and Kijun line, certain bullish pressure may be observed in the process before the price strongly pushes down towards 72.50 support area in the coming days. As the price remains below 75.50 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 72.50

RESISTANCE: 75.00-50, 77.50

BIAS: BEARISH

MOMENTUM: NON-VOLATILE