Eurozone

The euro managed to somewhat stabilize its position in the foreign exchange market after a month and a half of a steady decline. The reason was the first signs of slowing down in the decline of business activity. According to Markit, the PMI in the production area of the eurozone for the month of May remained stable while a slight increase was noted in Germany which was, besides preliminary data on inflation show growth, much higher than forecasts.

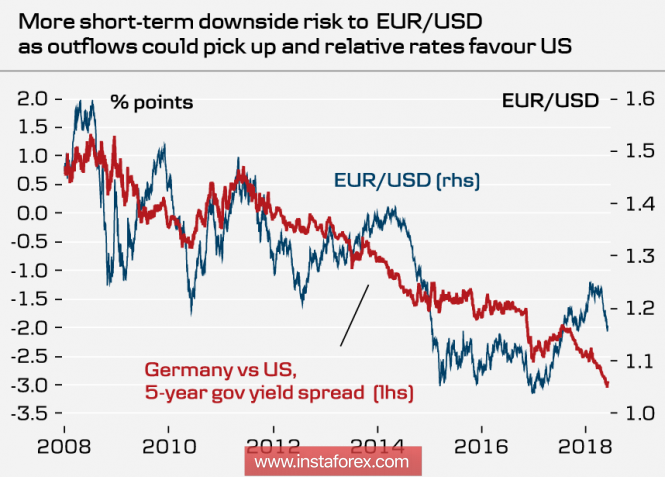

At the same time, these factors are unlikely to have a significant impact on the mood of players. The dynamics of the EURUSD pair will be determined by the main driver, which has been operating for the past 10 years: the growing spread between US and euro-zone bonds. The euro, at the end of 2017, attempted growth, which was justified by rumors of an impending curtailment of the asset repurchase program and the transition to normalization of interest rates. These rumors supported the euro for more than six months. One is currently clear that the ECB does not have any clear plans to move to a tight monetary policy and the markets do not expect the first rate hike before the second half of 2019.

The spread between 5-year US and German bonds is steadily growing in favor of the former, and therefore short-term attempts at euro growth will be sold out, and the EURUSD pair will continue to decline.

In Italy, the government has finally been formed, the power in the country has shifted to eurosceptics, which will strengthen the centrifugal sentiment in the euro area and will exert pressure on the euro. On Monday and Tuesday the new government will be approved in the parliament with priorities that can have a significant impact on the overall volatility of the euro.

Macroeconomic data is unlikely to have a significant impact on sentiment. On Monday, the EURUSD may decline to 1.1585.

United Kingdom

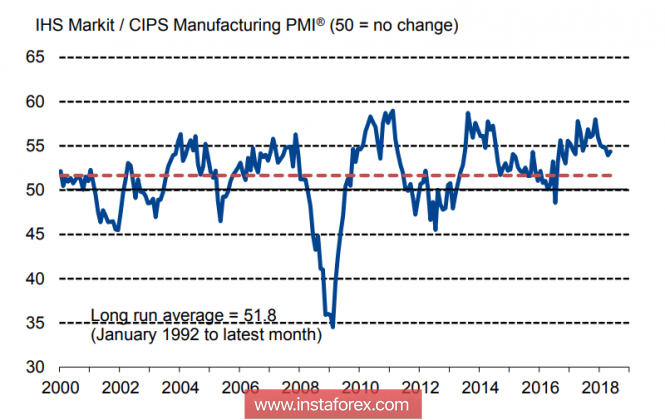

The pound makes active attempts to form a local minimum and stop the fall. Part of the improvement in the mood for the pound is due to positive statistics. The consumer confidence index from Gfk slightly increased in May from -9p. up to -7p, the Bank of England found a noticeable growth in consumer lending in April, while the PMI Markit index in the manufacturing sector in May rose to 54.4p after 6 months of decline.

This week, there is only one release, which can have a significant impact on the mood: PMI in the services sector for May. The key indicator of the strength of the British economy declined in 4 of the last 6 months. At the moment, negative forecasts have been replaced by neutral ones. The Lloyd barometer indicates some revival in May, taking into account the stabilization of PMI in the manufacturing sector, one can hope for some rebound in the services sector.

The Brexit factor is unlikely to have a significant market sentiment in the near future, as it is still a long time before the EU summit which will be held on June 28-29. Until this time, the key meeting of the US Federal Reserve will take place. The results now look much more important for the markets.

The pound is weak, despite attempts to form a bottom at the 6-month low. Corrective growth can raise the GBPUSD pair to 1.3460 but one must assume that attempts at growth will be highly likely to sell out. The pound will seek the support zones of 1.2830 / 70 in the next two weeks.

Oil

Oil is stable at the opening of trading on Monday. The increase in production in the US does not affect quotes due to inadequate transport infrastructure. The spread between the shipment price of shale oil and the Gulf of Mexico coast reached $ 20 by June 1.

The likely increase in OPEC + production before the June 22 summit will remain to be just rumors. The market is frightened by the contraction of supplies and the balance between supply and demand has not yet developed. A strong US employment report did not lead to a noticeable increase in the dollar index. The probability of testing the May low at 74.55 is not high, the trade will continue in the range with gravity to the upper limit above $ 79 / bbl.

The material has been provided by InstaForex Company - www.instaforex.com