EUR / USD

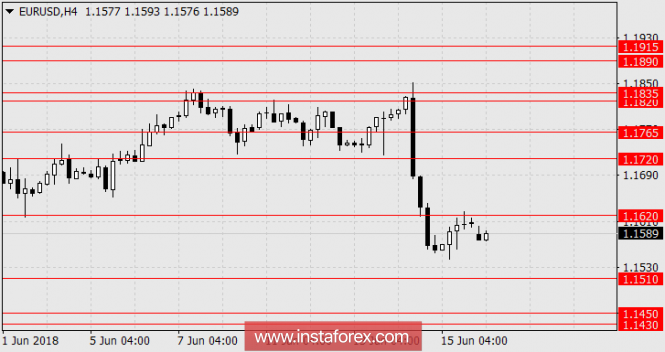

As a result on Friday, the euro corrected up by about 40 points at the unexpected fall in US industrial production in May, the indicator showed -0.1% against the forecast growth of 0.2%. The capacity utilization rate decreased from 78.1% to 77.9%. In the euro area trade balance showed a decline from 19.8 billion euros to 18.1 billion, but investors decided to record a profit with an overall neutral situation. The US consumer confidence index from the University of Michigan increased from 98.0 to 99.3 in June. A significant phenomenon in the market happened on Friday, as the oil fell at 3.95% due to the intention of OPEC + during the June 22-23 meeting to increase the quota for extraction. Also, gold fell on Friday by 1.70%. Commodity markets in the whole spectrum from metals to crops declined. All this suggests the continuous strengthening of the dollar in adjacent markets, and its growth on Forex is expected today.

In Italy, the trade balance for April is projected to decline from 4.53 billion euros to 3.21 billion euros. In the US, the business activity index in the housing market from NAHB for the current month is expected to remain unchanged at 70 points. Tomorrow, the eurozone balance of payments for April is expected to decrease from 32 billion euros to 30 billion, and the construction volume of new homes in the US in May is expected to increase from 1.28 million to 1.32 million. We are waiting for a decline in the euro to 1.1510.

* The presented analysis of the market is informative and is not a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com