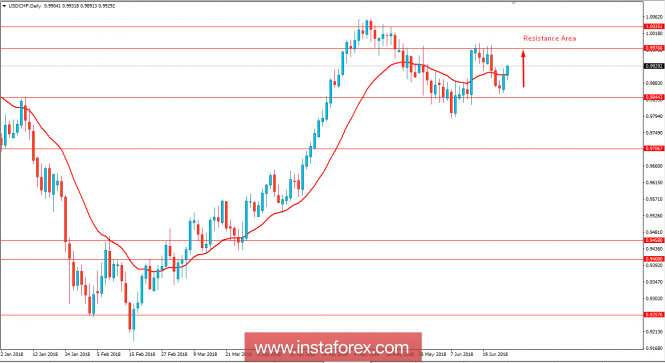

USD/CHF has been a bit bullish recently after bouncing off the 0.9850 area with a daily close. After certain retracement in the bullish trend, the price resumed the upward bias in a expected move. The question is open how the price is going to react, reaching the resistance area of 0.9980 to 1.0050.

After the recent rate hike ny the US Fed, USD has been quite impulsive with the gains over CHF which led the price to reach a new high of the year. After a series of downbeat economic reports from the US, the pair made pullbacks along the way. Amid lingering trade jitters, the pair has not gained obvious momentum. Today, US Core Durable Goods Orders report is going to be published which is expected to decrease to 0.5% from the previous value of 0.9%, Durable Goods Orders are expected to decrease in deficit to -0.9% from the previous value of -1.6%, Goods Trade Balance is expected to increase in deficit to -68.9B from the previous figure of -67.3B, and Prelim Wholesale Inventories report is expected to increase to 0.2% from the previous value of 0.1%. Additionally, Pending Home Sales report is expected to show an increase to 0.4% from the previous value of -1.3%, Crude Oil Inventories are expected to decrease in deficit to -2.4M from the previous figure of -5.9M. FOMC Member Quarles is going to speak today as well. His speech is likely to inject certain volatility in the market.

On the other hand, today Switzerland's Credit Suisse Economic Expectation report was published with a decrease to 8.0 from the previous figure of 28.0. Moreover, SNB Quarterly Bulletin is due today which is expected to inject certain volatility in the pair as well.

As for the current scenario, CHF is currently quite soft amid the recent economic reports and expectations whereas USD is expected to strengthen further in the coming days. Though certain corrections may be observed, USD is going to hold the upper hand in this pair.

Now let us look at the technical view. The price is currently heading higher with a target towards the resistance area of 0.9980-1.0035 which is also residing above the dynamic level of 20 EMA. On the back of the recent bullish momentum off the 0.9850 area, the price is expected to climb higher in the coming days, though certain correction and volatility may be observed. As the price remains above 0.97 area, the bullish bias is expected to continue further.