GBP/USD has recently broken above the 1.3950 resistance area with a daily close, while being in a non-volatile bullish trend where USD failed to put an impact for some retracement in the process. The UK has been doing quite well with economic reports despite political and Brexit headwinds. On the other hand, after the rate hike in December USD failed to retain the momentum it had earlier. Today, UK Public Sector Net Borrowing report was published with a positive result of a decrease to 1.0B from the previous figure of 6.6B which was expected to be at 4.2. The positive economic report helped the currency to regain its momentum it has lost throughout the day. Now GBP is expected to push further upwards in the coming days. On the other hand, ahead of the Advance GDP report from the US to be published on Friday, today Richmond Manufacturing Index report is going to be published which is expected to have a slight decrease to 19 from the previous figure of 20. The economic report will hardly have a serious impact on USD in the short term, whereas GBP seemed quite strong with more first-tier economic reports. As for the current scenario, GBP is expected to dominate USD further until the US comes up with any positive high impact economic reports in the coming days to halt the impulsive bullish momentum in this pair.

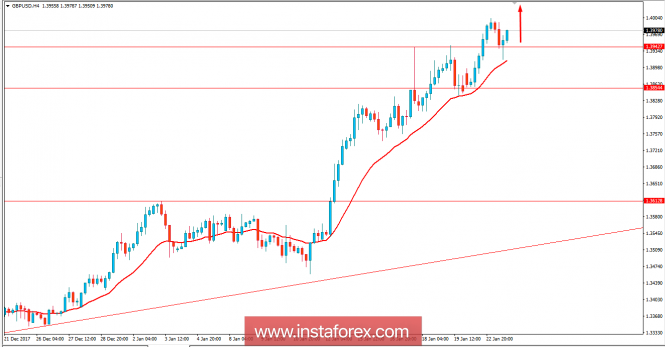

Now let us look at the technical chart. The trend has been non-volatile where the dynamic level of 20 EMA worked as a strong support to push the price higher after every retracement along the way. Recently the price rejected off the 1.3950 area with an intraday close which lead to further confirmation of the impulsive bullish pressure in the pair. As the price remains above 1.3850 area, the bullish bias is expected to continue further with a target towards 1.4050 and later towards 1.4650 in the long run.