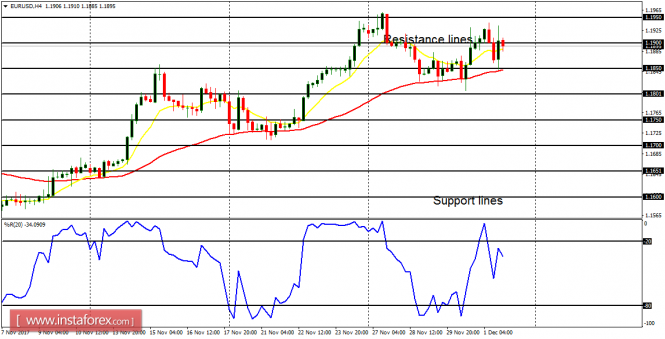

EUR/USD: The EUR/USD met a considerable challenge last week –which threatened the recent bullishness in the market. However, bulls were able to save the bias on Thursday as they pushed price slightly higher. Further bullish movement is possible this week, for the price could target the resistance lines at 1.1900, 1.1950 and 1.2000. A stubborn opposition would be met the resistance line at 1.2000.

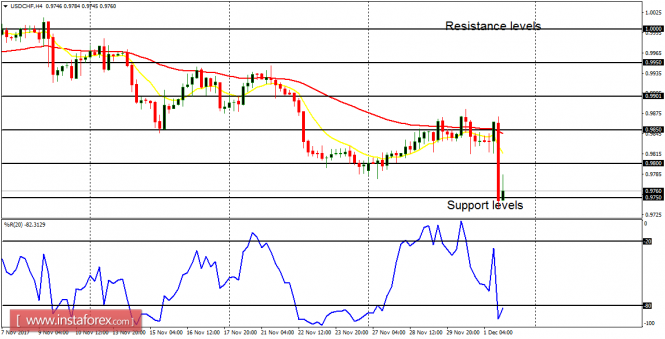

USD/CHF: This pair made an effort to rally last week, but the rally effort was rejected around the resistance level at 0.9850 (which was briefly breached to the upside, and price could not stay above it). There was a large pullback on Friday, which put more emphasis on the recent bearish bias. There cannot be a meaningful rally on the USD/CHF as long as the EUR/USD is able to showcase its strength.

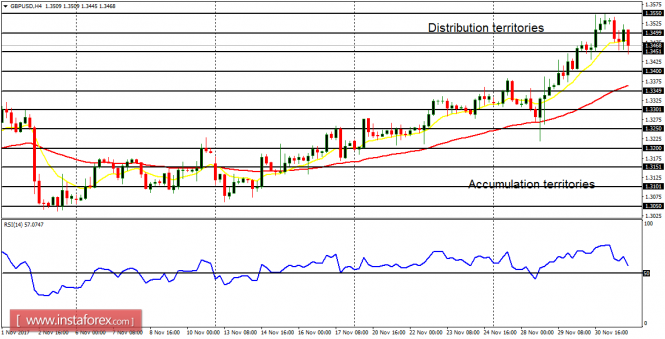

GBP/USD: The persistent bullish effort on GBP/USD has already paid off, and the price has gained 460 pips since November 13. There was a slight bearish correction on Friday, after which price would resume its bullish journey, targeting the distribution territories at 1.3500, 1.3550 and 1.3600.

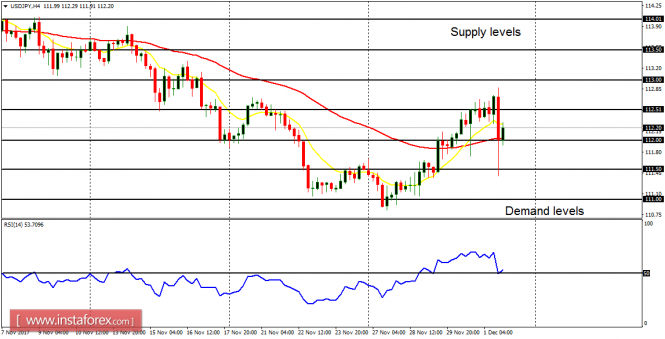

USD/JPY: The bias on this currency trading instrument is essentially bearish. After testing the supply level at 114.50 in November, the price went downwards by 330 pips. Nonetheless, there was a rally attempt last week, which would enable sellers to enter the market at great prices, the provided price goes southwards from here.

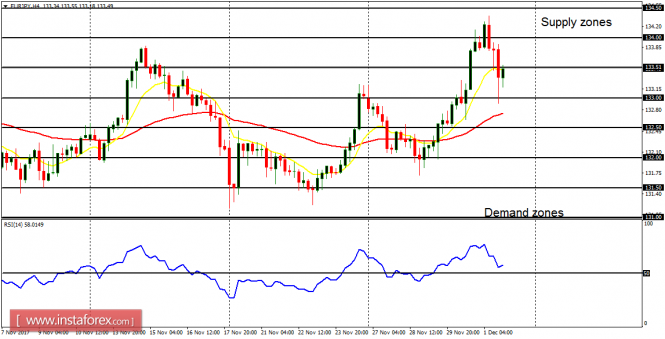

EUR/JPY: This cross is choppy in the long-term and bullish in the short-term. The price went downwards on Monday and Tuesday, reaching the demand zone at 132.00 and then going upwards on Wednesday. The supply zone at 134.00 was reached before there was the ongoing bearish correction. The price should go upwards this week, reaching the supply zone at 134.00, breaching it to the upside, and putting more emphasis on the novel bullish bias.