There was no response against the argument. No matter how good the macroeconomic indicators of the UK have been lately, the bulls in the GBP/USD are not able to fight political risks. Strong data on industrial production and foreign trade allowed the British pound to go above the base of the 32nd mark against the US dollar. However, another scandal surrounding the UK government caused the sterling to hit the ground.

Following the dismissal of the Secretary of State for International Development Priti Patel, due to unauthorized meetings of the latter with Israeli officials, the Sunday Times struck a blow at Prime Minister Theresa May. According to the popular tabloid, 40 representatives of the Conservative Party put their signatures under a letter of no confidence in their leader Theresa May. It continues to find eight more, and afterwards the process of her removal from power will be launched.

The confusion surrounding the government significantly worries investors, which increases the pound's volatility. This is because a change in the structure of the Cabinet would complicate the difficult negotiations on Brexit. The case of divorce is in full swing, and the U.K. economy already feels the consequences of a breakup in its long-standing ties. According to the forecasts of the European Commission, it will slow to 1.5% in 2017, to 1.3% in 2018 and to 1.1% in 2019. The lagging dynamics of the British GDP for European and American counterparts allows us to count on the stability of the upward trend in the EUR/GBP pair and the "bearish" trend in the the GBP/USD pair even against the backdrop of tightening of the BoE monetary policy.

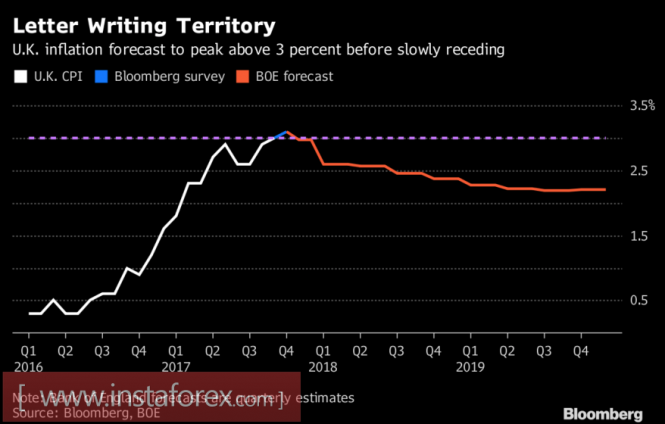

Mark Carney and his colleagues are in a very difficult situation. According to the consensus forecast of Bloomberg experts, according to the results of October, consumer prices will reach + 3.1%, which is higher than the estimates of the Bank of England. Carney's division will have to write an explanatory note to the Treasury and give additional arguments in favor of the temporary nature of the acceleration of the indicator.

Dynamics of actual and projected inflation in Britain

Source: Bloomberg.

Along with the publication of data on consumer prices and core inflation, the pound will pass the test of releases of data on the labor market and retail sales. Forecasts are disappointing: according to the second indicator on an annual basis, Bloomberg experts are expecting the first withdrawal to negative since April 2013; it is likely that the average wage growth will slow from 2.2% to 2.1% y/y, which will pose as an additional blow to the purchasing power of the population. If we add to this the political risks, then the picture for sterling is drawn in gray tones.

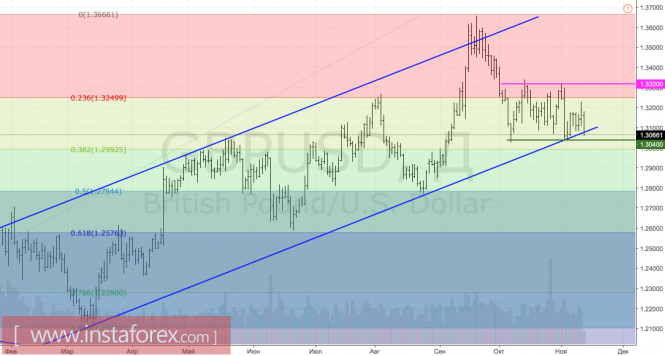

In such a situation, much will depend on progress in the implementation of tax reform in the United States. If the process goes along the path indicated by Finance Minister Steve Mnuchin (who is certain that the repair of the fiscal system will be approved by Congress before Christmas), then the GBP/USD pair will easily decline towards the level of 1.29. If the majority's opinion is embodied in life (there is no need to expect progress on tax reform before the end of the year), then the pound will remain restrained to a consolidation in the range of 1.3-1.33.

Technically, a break in the bottom of the upward trading channel will increase the risk of continuing the peak towards the direction of 1.28.

GBP/USD, daily chart