The growth of geopolitical tensions in the Middle East has become a catalyst for the rise of oil prices to its highest in 2.5 years. From the level of June lows, Brent added about 40% against the backdrop of information about mass sweeps in Saudi Arabia and the ballistic missile from Yemen that reached Riyadh. For a long time, investors have missed all kinds of conflicts, paying attention only to the efforts of OPEC and shale mining in the United States. As soon as it became clear that the market is ready to reach the balance, they needed a new driver of growth. This became the events in the Middle East.

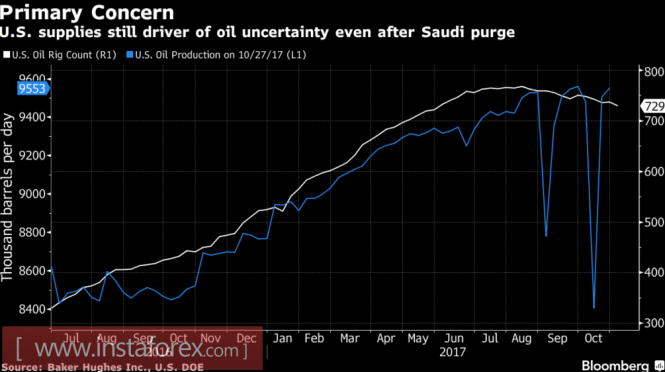

Currently, a few doubt that in late November, the cartel will extend the validity of the Vienna agreement to reduce production, at least until the end of 2018. At the same time, a reduction in the number of drilling rigs in the United States suggests that American companies have begun to pay more attention to issues such as profitability. By the end of week of November 3, Baker Hughes reported a drop of 8. The total number of drilling rigs is 729. The plan is to let the production in the States rise to its highest in more than 2 years (9.55 million b / s). However, the correlation of the two indicators may not help in damping the pulse. If a few weeks ago the accredited US companies tried to pay off their debts by increasing production, now they have an alternative.

The dynamics of the number of drilling rigs and oil production in the US

Source: Bloomberg.

Thus, opponents seem to have come to a reasonable compromise. The emergence of a geopolitical factor tipped the scales towards the "bulls" for Brent and WTI. It has repeatedly pointed out that the fact that the burning Middle East, against the background of a surplus and balance, is completely different. This could be seen in the second half of the autumn. Conflicts between Kurdistan and Turkey, Saudi Arabia and the Iranian rebels behind Iran, the growing risks of resuscitation of Western sanctions against Tehran because of Donald Trump's dissatisfaction with the history of the nuclear program in that country and, finally, the arrest of 11 princes and dozens of officials and businessmen in the Ayr - Riyadh has become a catalyst for the rapid rally of oil futures. In the end, what seemed impossible a couple of weeks ago, seems quite real now. The market is seriously discussing the possibility of Brent rising to around $70 per barrel.

BofA Merrill Lynch call the figure $75 in the near future. Commerzbank, on the contrary, is confident that the fundamental data does not justify the current price of black gold. Despite the corruption scandal in Saudi Arabia, the oil policy of Riyadh remains unchanged. The geopolitical conflict between them and Tehran may develop into a serious discussion over the prolongation of the Vienna agreement.

Technically, the targets for 161.8% and 261.8% for the patterns of AB = CD, indicating that the upside potential of Brent is far from exhausted.

Brent, daily chart