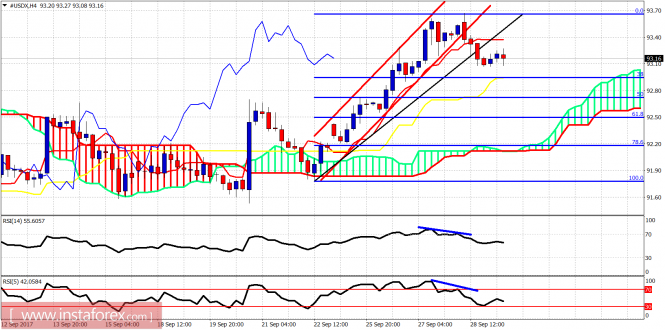

The Dollar index made a pullback yesterday after being rejected at the daily cloud resistance of 93.70 as we expected. Short-term trend remains bullish and the current downward move is still considered a pullback. However I believe that this downward move will soon accelerate.

The Dollar index has broken down and out of the bullish channel. This at least will bring a corrective pullback towards the 38% Fibonacci retracement. The 38% Fibonacci retracement at 92.95 is the first important short-term support. Next support is at 92.50 (61.8% Fibonacci retracement).