The dollar rose slightly on Wednesday after the announcement of the results of the two-day meeting of the US Federal Reserve, which generally met the expectations of the market.

FOMC announced its intention to launch a program to normalize the balance sheet in October. It is expected that the monthly volume of cuts will be $ 10 billion.

The Fed's updated forecasts on rates and the economy also generally met expectations. The forecast for GDP for 2017 increased from 2.2% to 2.4%, and the forecast for the unemployment rate for 2018/19 was also improved, but the forecast for core inflation for the next two years was worsened.

Most of all the market was interested in the forecast on rates. The Fed confirmed its intention to raise the rate again this year and three times in 2018, which led to an increase in market expectations of up to 72% (according to the CME futures market data).

At the press conference, Janet Yellen did not directly answer the question of why the Fed does not react to the slowing of inflation by mitigating the policy. Yellen answered only that she was "inspired" by improvements in the labor market. The answer of the head of the FRS should be understood in such a way that the regulator continues to believe in the "Philips curve" and assumes that the factor of full employment will ensure inflation growth.

Eurozone

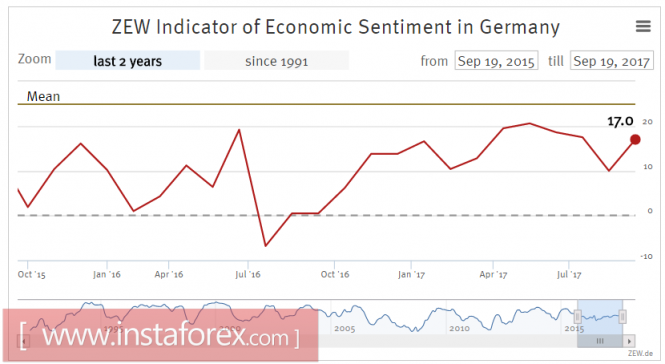

The economic sentiment indicator in Germany ZEW increased in September to 17.0p. against 10.0p a month earlier, but remains below the long-term average of 23.8p. In the release notes that the German economy is experiencing strong growth, markedly increased bank lending and investment activities of both the government and private firms.

The euro, which in recent years has been actively used as a funding currency, remains under pressure amid growing interest in risk. The probability of correction by EUR/USD to 1.16 is preserved against the background of a high probability of dollar growth in the short term.

United Kingdom

Retail sales unexpectedly rose in August, well above forecasts, the fastest pace in the last 4 months. The growth was 1.0% vs. 0.6% a month earlier, a year-on-year growth of 2.4% vs. 1.4%, in both cases the market expected a slowdown, not growth.

Strong growth in retail sales increases the likelihood of the Bank of England tightening its program. At the same time, the market reacted quite moderately to surprisingly high rates, the pound did not leave the hour channel and quickly returned to the average daily levels.

Negotiations on Brexit remain a strong risk factor. More and more politicians are inclined to the fact that the negotiations will fail, and the EU and Britain will be forced in their trade relations to switch from the free trade regime to WTO rules, which will cause the British economy more damage than currently estimated by the market. British banks may lose the right to conduct business in the EU without creating subsidiaries, which will inevitably worsen the state of the financial system, and the reduction in exports due to rising tariff rates will jeopardize the labor market and the real incomes of citizens.

The pound showed impressive dynamics in the last month, however, for the continuation of the growth of the grounds, so far. The pound may update its maximum and reach 1.3850 / 3950, but only if there are real grounds for expecting a positive in Brexit negotiations. More likely scenario is the corrective reduction in the support zone of 1.3100 / 3250.

Oil and the ruble

The OPEC Technical Committee on Monitoring said on Wednesday that the OPEC + agreement was fulfilled in August by 116%, which is much higher than 94% a month earlier, and by the end of the first half of the year, compliance with the agreement was 98%, which can be regarded as a clear success. On September 22, the committee will hold a special meeting in preparation for the ministerial meeting in November, where it is expected that a decision on the extension of the agreement after March 2018 will be taken.

The decision of the FOMC to raise the forecast for GDP for 2017 also had an impact on the growth of quotations, as it indicates the probability of outstripping demand for oil and oil products.

Brent for the first time since April has risen above $ 56 per barrel, positive sentiments continue to dominate.

The decline in the ruble is corrective after a steady growth in August-September. The strengthening of the ruble is currently hindered by the growth of the dollar after the meeting of the FOMC, but in the long term the ruble feels quite confident, and one can expect that the factor of growing oil and the approaching tax period will prevail in investor sentiment. For the short term one can expect the end of the weakening period and the decrease of USD/RUB to 57.50.

The material has been provided by InstaForex Company - www.instaforex.com