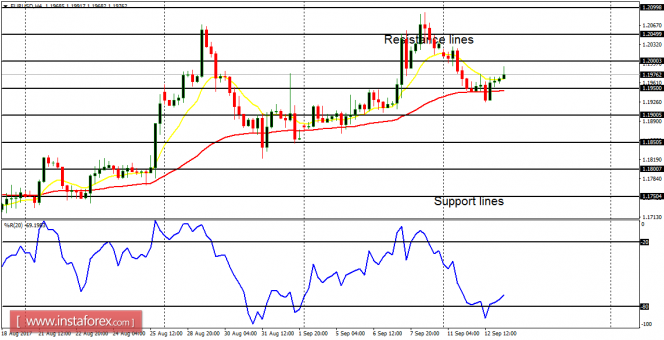

EUR/USD: It may be prudent to stay away from this pair until there is a directional movement. The EMAs 11 and 56 are giving a bullish indication, and the Williams' % Range period 20 is giving a bearish indication. When price trends in a direction, the indicators would agree with one another. A movement below the support line at 1.1850 would result in a bearish bias, while a movement above the resistance line at 1.2050 would help strengthen it.

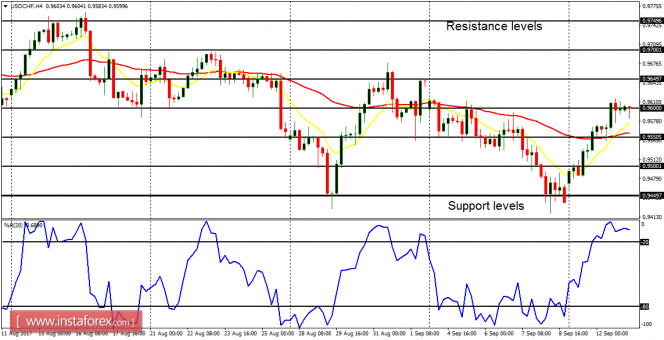

USD/CHF: A "buy" signal has finally been generated on this pair – especially in the short term. The EMA 11 has crossed the EMA 56 to the upside, while the Williams' % Range period 20 is in the overbought region. Price could now target the resistance levels at 0.9650 and 0.9700.

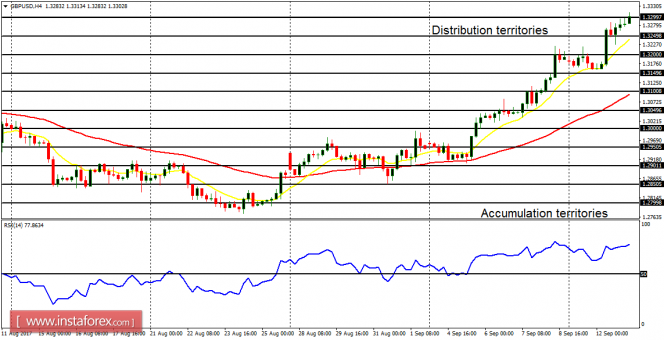

GBP/USD: This currency trading instrument has moved upwards by close to 360 pips since the beginning of last week. The accumulation territory at 1.3300 has been breached to the upside, as price targets another distribution territories at 1.3350 and 1.3400. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. A further bullish movement is logically anticipated.

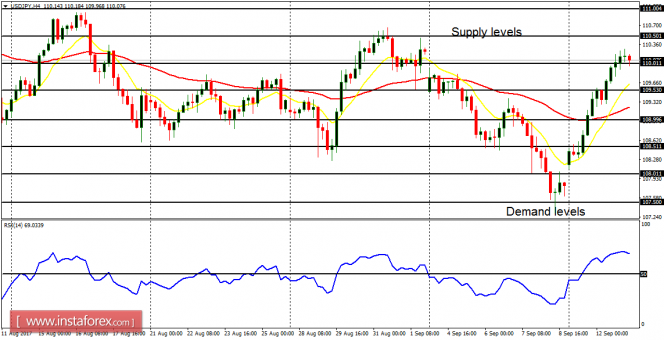

USD/JPY: There is now a clean bullish signal on USD/JPY, for price has gone upwards by 200 pips this week. Price is now above the demand level at 110.00, going towards the supply levels at 110.50, 111.00 and 111.50. There is a Bullish Confirmation Pattern on the 4-hour chart, which shows that bulls reign.

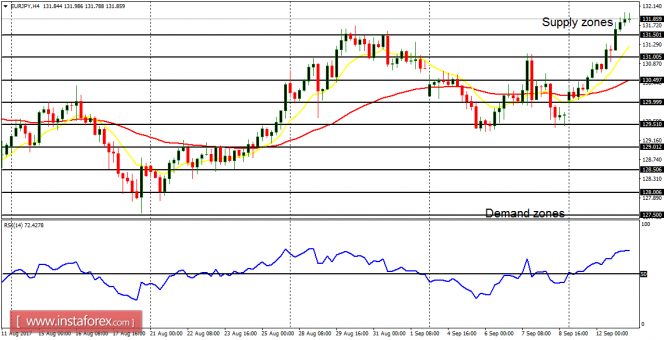

EUR/JPY: The EUR/JPY pair has gone upwards by 200 pips this week, now testing the supply zone at 132.00. The supply zone would be breached to the upside as price targets other supply zones at 132.50 and 133.00, which would be reached today or tomorrow. The bias on the market is now bullish.