Investors in the oil market were initially thrown into the heat then to the cold. Brent and WTI marked an 8-day rally, then dropped for six days in a row. Stabilizing the situation supported rumors on the dissatisfaction of OPEC members with the production growth of Libya and Nigeria, who were exempted from obligations, that reduced the volume of planned oil output by a third to the balance of the scale of production cuts. A critical decision on these countries will be taken at the end of July in Moscow, but Goldman Sachs argues that it will not be able to support oil. In order for WTI to not collapse below $40 per barrel, we need a new cut from the group, which is currently not being discussed.

Looking at the movement of the futures of both varieties, it appears that the "bears" have yet to dominate. Oil poorly responded to positive news and quickly fell into the negative. In this respect, Thomson Reuters reported growth in OPEC exports to 25.92 million barrels per day in June, up by 450,000 bpd from May and 1.9 million bpd more than a year earlier, became the catalyst for sales. However, a much greater impact came from the report of the U.S. Energy Information Administration, in which, along with the reduction in inventories, there was room for news on the rise of overall production to 9.34 million bbls. The decline at the end of last week was seen as a temporary event, which allowed the "bears" on Brent and WTI to go on another attack.

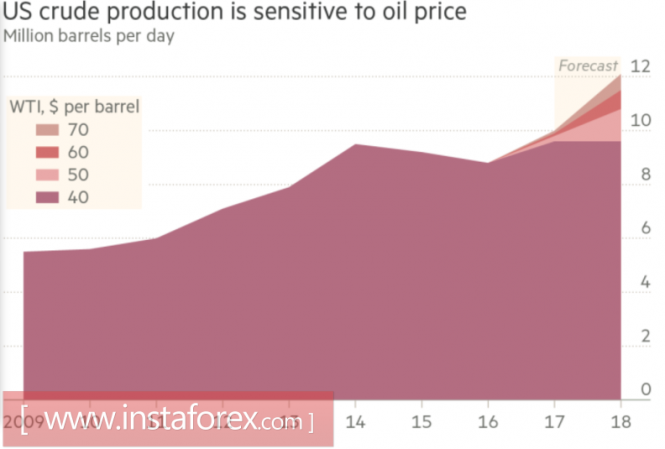

It just so happened that the supply is currently on the US side, which miraculously survived due to OPEC's decision to cut production at the end of 2016. Bank of America Merrill Lynch claims that every dollar is equivalent to 100,000 bbls. That is, if WTI will climb to $1, then US companies will increase oil production by 100,000 bbls, if it falls by $1, then production will drop by the same amount. Thus, the fall in oil prices to $40 per barrel will result in a decline in the figure to 9.6 million bbls in 2017 (EIA predicts it will be 10 million bbls), and the growth of futures prices for the Texas grade to $70 will raise production to 12.1 million bbls. Would it be able to withstand the OPEC with its -1.8 million b/d rate???

Dynamics of oil production in the USA

Source: Financial Times.

In such a situation, the decline in the forecast of Goldman Sachs on WTI from $55.0 to $47.5 for the third quarter appears quite reasonable. "Bears" kept a tight hold on the market, and all the success of the "bulls" are more of a local disposition. Until the production and the number of drilling rigs in the United States have not been steadily declining or until there are signs of the global oil market rebalancing, Brent and WTI sales will continue to be relevant.

Technically, the inability of the Brent bulls to keep the support at $46.55 per barrel (38.2% of the last upward long-wave) will raise the risk of continuing the peak towards the direction of $44 (the lower limit of the downward channel) and $42.8. On the contrary, if buyers of the North Sea crude variety are unyielding, then we are waiting for a return of prices to $49-50 per barrel.

Brent, daily chart