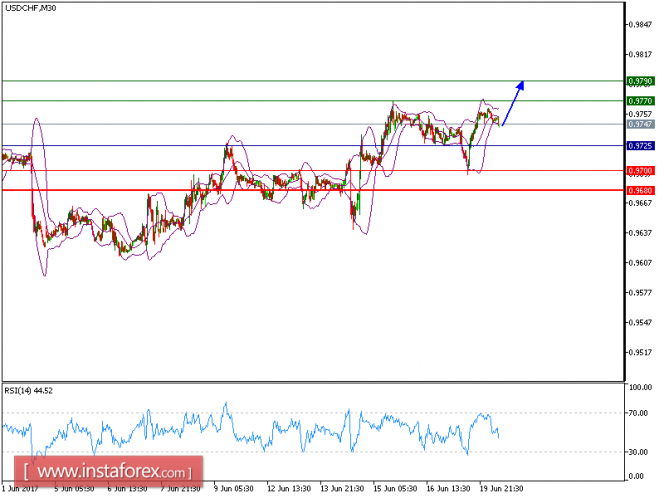

The outlook of USD/CHF is still bullish and it is expected to move upward. The pair posted a rebound and broke above 20-period and 50-period moving averages. In addition, the bullish cross between 20-period and 50-period moving averages has been identified. The relative strength index broke above the declining trend line since June 14.

Yesterday, the U.S. dollar was buoyed by the hawkish tone of New York Fed President William Dudley, who also said, "inflation is a little lower than what we would like, but we think that if the labor market continues to tighten, wages will gradually pick up, and with that inflation will gradually get back to 2 percent."

Therefore, as long as 0.9725 is not broken, look for a further upside to 0.9770 and even to 0.9790 in extension.

Graph Explanation: The black line shows the pivot point, present price above pivot point indicates the bullish position and below pivot points indicates the short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY at dips, Stop Loss: 0.9725, Take Profit: 0.9770

Resistance levels: 0.9770, 0.9790, and 0.9875

Support levels: 0.97000, 0.9680, and 0.9655

The material has been provided by InstaForex Company - www.instaforex.com