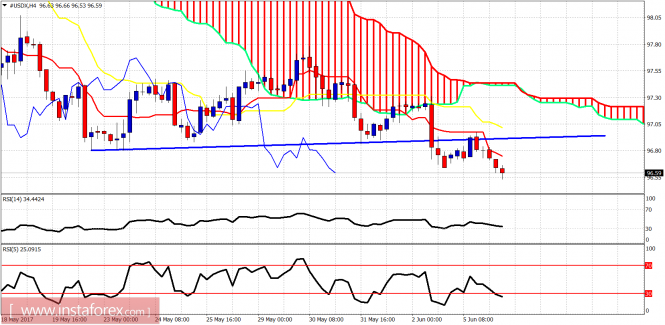

Remaining in a bearish trend and providing lower lows and lower highs, I continue to feel that the risk reward favors bulls rather than bears. As said in my previous posts, I prefer to be at least neutral if not bullish around 96-97 area.

The Dollar index broke out and below the trading range and has now 97 as resistance (once support). Trend remains bearish. Only a move above 97.30 will change short-term trend to bullish. I can see bullish divergence signals by the RSI and I continue to focus on a reversal signal.

The weekly chart is ugly. Price has broken below the weekly Kumo (cloud) support and is inside a bearish channel. Channel support is at 96 and this is my next target and reversal area. I would then expect a reversal and back test towards cloud resistance at 97.85-98 at least.

The material has been provided by InstaForex Company - www.instaforex.com