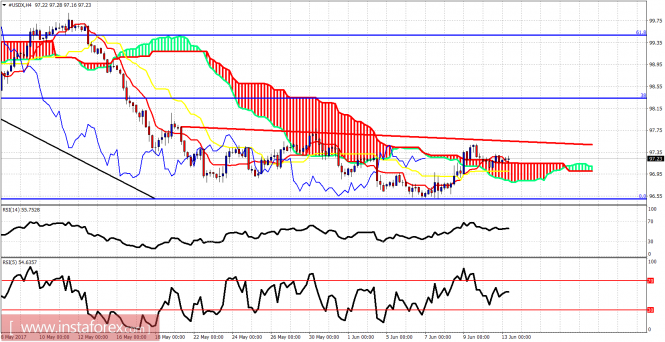

The Dollar index continues to point to a bounce towards 98.5-99 and I continue to favor the bullish side. I believe that only after a bounce towards 99 we should look to short the index again.

The Dollar index is trying to break above and remain above the 4-hour Kumo (cloud). Short-term trend has changed to bullish and short-term support is at 97 where the 4-hour kijun-sen is found. Resistance is at 97.50. If broken, we will have started the move to 98.50-99.

The Dollar index has broken below the weekly Kumo. Weekly trend is bearish. However, I would expect a bounce back inside the Kumo and towards the upper channel boundary or at least the lower cloud boundary at 98. I remain short-term bullish about the Dollar index.

The material has been provided by InstaForex Company - www.instaforex.com