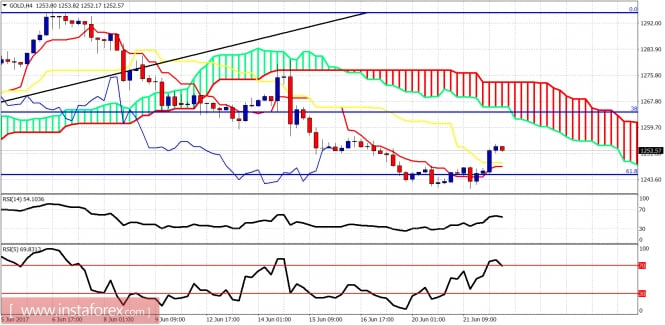

Gold price bounced off the 61.8% Fibonacci retracement and the $1,245-40 area as expected. Price should test the $1,260 short-term resistance area. A rejection there will open the way for a push towards $1,200, but if the week closes around $1,260 and higher, we could have a bullish reversal sign on a weekly basis.

Blue line - long-term support

Gold weekly chart could shape up to be a very bullish one as the candle formation of this week touched the weekly Kumo (cloud) support as expected and bounced higher. This long-tailed candle is a bullish reversal sign and will strengthen the higher we close this week. I'm short-term and longer-term bullish about Gold.

The material has been provided by InstaForex Company - www.instaforex.com