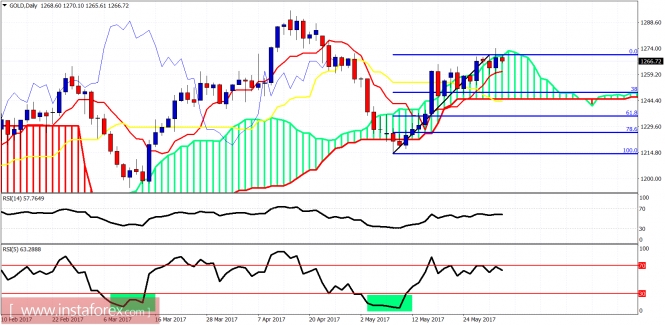

Gold price has reached the upper trading range boundary resistance and is pulling back down. Short-term traders could try and profit from short positions with tight stops at $1,275 as a pullback towards the lower boundary level is justified.

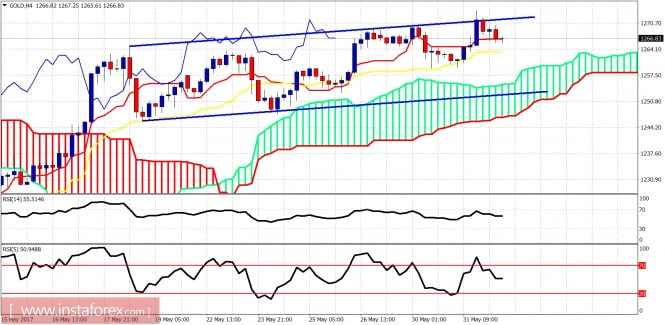

Gold price got rejected at the upper blue trading range boundary. Price remains above both the tenkan- and kijun-sen indicators. Trend remains bullish. As said in previous posts, we could see a slow grind higher but overall I expect price to pull back towards $1,255.