4-hour timeframe

Amplitude of the last 5 days (high-low): 56p - 100p - 100p - 68p - 116p.

Average amplitude over the last 5 days: 88p (76p).

British Prime Minister Boris Johnson, who has recently received more attention than the odious Donald Trump, made his first visit to the European Union, France. The purpose of the visit was to negotiate with President Emaanuel Macron on the terms of the Brexit deal, or rather, the "back-stop" clause that Johnson wants to cancel. Earlier, the first attempt to convince Brussels had already failed: the President of the European Council Donald Tusk rejected Johnson's proposal to reconsider the agreement. It became known that Macron did not support Boris Johnson's initiative to cancel the "backstop". Therefore, Johnson will now meet with German Chancellor Angela Merkel, but the hope that the UK prime minister will find support in Berlin is even less. Actually, nothing surprising has happened. We have already noted more than once that Johnson's actions very often resemble actions with the goal of creating a certain appearance. Apparently, the prime minister is trying hard to revise the agreement with the EU in order to avoid a hard scenario for leaving the EU. What for? In order to convince Parliament to vote "for" the "hard" Brexit. The reasons in this case will be simple: the EU refused to revise the agreement. The same thing is in the eyes of the British population: Johnson tried to negotiate with the EU, but the Europeans refused. That's it, Boris Johnson did everything he could. In fact, Johnson did not offer the European Union anything on the basis of which the "deal" could be reconsidered. That is, nothing at all. The British prime minister simply hoped that the EU leaders would agree to revise the agreement from "out of the blue", which had been worked on for about 2 years. Naturally, he was refused.

Based on the foregoing, we do not expect Johnson's visit to the EU to end with something encouraging for Brexit. Most likely, the prime minister will return to Britain and continue to prepare for the hard Brexit, and the Parliament, which will soon leave the holidays, will continue to prepare for a vote of no confidence in Johnson.

Well, the pound will remain in a downward trend, since the date of the hard Brexit is approaching, there is no hope that the "divorce" will take place amicably.

Trading recommendations:

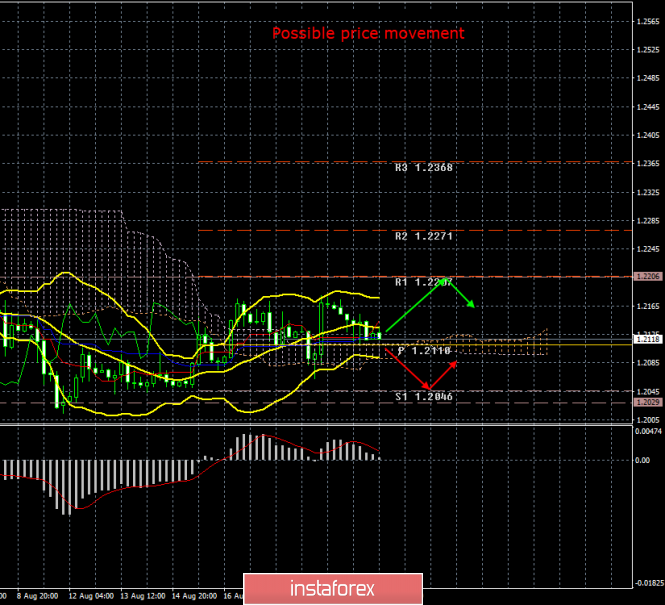

The pound/dollar currency pair has begun a new round of a downward correction against an upward trend. Thus, formally, purchases of the pound sterling by minimum lots with the target of 1.2207 remain formally relevant, however, in fact, purchases of the British pound in the current conditions are fraught with increased risks.

In addition to the technical picture, fundamental data and the time of their release should also be considered.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

The material has been provided by InstaForex Company - www.instaforex.com