Growing tensions in world markets remain the most important factor that threatens the current fragile stability in financial markets.

Given the growth of political risks in the United States in anticipation of congressional elections in November, the debt problems in Italy, which have worsened recently and put pressure on the single European currency, and all this is happening against the background of Brexit and large-scale trade war between the United States and China. One can say that the chaos in the financial markets, produced by Washington, will only increase.

The pressure of this process, accompanied by a rise in interest rates by the Fed, as well as a reduction in its balance, which has somehow been stopped in the expert community, threatens, in our opinion, an increase in the chaos in the financial markets and then dumping the global economy into a new recession. Here, the question arises: What defensive assets will be in demand by investors?

If, during the active phase of the 2008–09 crisis, they were actively buying up government bonds of economically developed countries, gold, Japanese yen, Swiss francs, and, of course, the US dollar, then with the start of a new wave of financial crisis, the preferences of market players may change somewhat. And here, geopolitics and change in the landscape of trade between Europe, China and a number of other countries on the one hand, and the USA on the other, can play a big role.

World markets may not be perceived as a single whole due to the intensification of protectionism and competition, mixed up in a military confrontation. World trade can split into several influential centers, which can lead to a change in preferences among market players to buy certain assets to ensure their risks.

In our opinion, the start of the beginning of the active phase of these processes can be given on the basis of elections to the American parliament. In the meantime, most likely, the relative lull in the currency markets will continue. We expect the overall sideways trend in major currency pairs to continue.

Forecast of the day:

The GBP / USD currency pair is trading above the level of 1.2950. It is adversely affected by the futility of the Brexit's sweetheart solution between the EU and the UK. We consider it possible to sell the pair on growth from 1.3000 or on its decline below 1.2950 with a likely target of 1.2850.

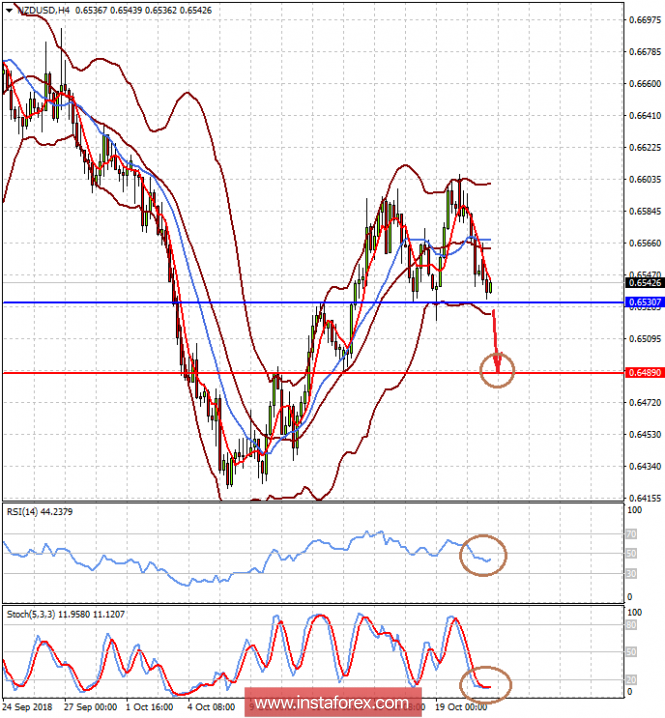

The currency pair NZD / USD is trading above the level of 0.6530. Pressure on it is exerted by growing tensions in trade between the United States and China. From a technical point of view, the pair forms a double top reversal pattern. A breakout at the price of 0.6530 could lead to the resumption of the fall of the pair to 0.6490.